Investing in gold coins can be a smart financial decision, but it’s also not an easy one. This guide aims to provide insight into what types of gold coins are best for investing, factors to consider, where to buy them and how to develop a winning investment strategy.

What to look out for when buying gold coins

- Purity: Not all gold coins are created equal. The purity of the gold used in the coin is a crucial factor. Typically, investment grade gold coins are at least 22 karat, with the best being 24 karat.

- Recognizability: Go for coins that are widely recognized and trusted. This makes it easier to resell them at a competitive price. Coins like the American Gold Eagle, Canadian Gold Maple Leaf, and South African Krugerrand have high liquidity.

- Historical Value : Some coins also have numismatic value, meaning they are collector’s items and can appreciate in value beyond the value of the gold they contain. However, unless you are a numismatist, you should generally focus on bullion coins rather than collectibles.

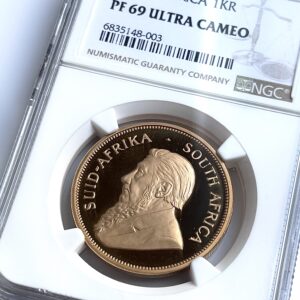

- Certification: Always opt for coins that come with certificates of authenticity and have been graded by reputable agencies such as Numismatic Guaranty Corporation (NGC) or the Professional Coin Grading Service (PCGS).

Which size of gold coin is the best: 1 ounce or smaller?

The popularity of gold coins – whether 1 ounce or smaller – depends largely on investor goals, market conditions, and sometimes even cultural preferences. However, there are some general trends:

1 ounce gold coins

One ounce gold coins are perhaps the most commonly traded form of gold investment. They are highly liquid and widely recognized, making them easy to buy or sell anywhere in the world. Popular 1 ounce gold coins include the South African Krugerrand, the American Gold Eagle, and the Canadian Gold Maple Leaf. These coins are often the first choice for investors looking to hold a significant amount of gold in a relatively compact form.

Benefits:

- High Liquidity : Easier to buy and sell.

- Lower Premiums : In general, production costs per ounce are lower, giving you more gold for your money.

- Widely Recognized : Accepted and recognized worldwide.

Smaller gold coins

Smaller gold coins such as 1/2 ounce, 1/4 ounce, or 1/10 ounce coins are also popular but serve different purposes. They are often bought as gifts or for those who are just starting to invest in gold. They’re also handy for investors who want the flexibility to sell smaller amounts of gold over time.

Benefits:

- Easier to Sell Smaller Lots : You don’t have to sell an entire ounce at a time.

- Lower Entry Point : More affordable for those starting out in gold investing.

Conclusion

Both 1 ounce coins and smaller gold coins have their merits. If you are looking for a long-term investment and want to keep a significant portion of your wealth in gold, 1 ounce coins are generally less expensive and more liquid. On the other hand, if you prefer more flexibility or want a lower entry point into the gold market, smaller coins might be a better choice.

Top 10 most popular gold coins that are considered good bullion coins

South African Krugerrand : The Krugerrand is one of the oldest gold coins in existence, in both regular and proof versions. You may also be interested in: Proof Coins vs. Bullion Coins: Which is Better than Investing in Gold Coins?

American Eagle Gold Proof Coins : They are among the most popular gold coins in the United States and are well known internationally as well. They come in a variety of denominations and are often purchased for both their gold content and collector’s value.

Canadian Gold Maple Leaf : This coin series is highly coveted and respected worldwide. The Royal Canadian Mint often issues special Proof versions that attract collectors.

British Gold Sovereign : A coin steeped in history, often available in proof editions. It is small, easy to store and recognized worldwide.

Australian Kangaroo/Nugget Coins : Issued by the Perth Mint These coins are not only beautiful, they contain high quality gold. The proof editions are often very popular.

Chinese Gold Panda : These coins are very popular both in China and internationally. Every year the design changes, which is an additional collecting factor.

Austrian Philharmonic : Known for its beautiful design and quality embossing, it is popular in Europe and other parts of the world.

Swiss Vreneli : Although not as well known internationally as other coins, it holds a special place among collectors and the Proof versions are highly sought after.

Mexican Libertad : This coin is prized not only for its gold content but also for its beautiful design.

French and Swiss Francs : Older European gold coins such as the 20-franc Swiss Helvetia and the French 20-franc Rooster are also popular with certain collectors and investors.

When investing in gold coins, pay attention to factors such as the purity of the gold, the reputation of the mint, the historical importance of the coin, and its rarity. Always consult experts or do extensive research yourself to see if a particular coin meets your investment criteria.

Where to find gold coins for investment

Authorized Dealers : Buying from an authorized dealer is generally the safest route. These dealers are verified by government mints and are considered extremely trustworthy. Many dealers are registered partners in well-known online shops (e.g. MA shops https://www.ma-shops.de – go to “Select shop” to see the dealers registered there) and are considered extremely reliable.

Online Marketplaces : Specialized online stores can offer a variety of options, often at lower prices. However, make sure the site uses secure protocols like HTTPS and read reviews before making a purchase.

Auctions : Rare and valuable coins are often offered at auctions. Sites like Heritage Auctions, Künker, Gadoury are good platforms but require a deep understanding of coin grading.

Development of a successful investment strategy

Education : Knowledge is power. The more you know about gold coins, the better your investment decisions will be. Read books, participate in online forums, attend a money fair – say the World Money Fair , and maybe even take a class on gold investing.

Some details about the annual World Money Fair in Berlin

The World Money Fair is the world’s most important coin fair and takes place in Berlin every year, usually in late January or early February. This important event in the international coin scene attracts dealers, accessory suppliers and auction houses from all over the world to present their numismatic collections. State and private mints will also present their latest offerings. In terms of technology, the fair is a meeting place for machine builders and suppliers involved in all phases of coin and medal manufacturing, from the production of the blanks to the minting and packaging processes.

The World Money Fair was originally launched in Switzerland in January 1972 under the name “International Coin Exchange” and has changed a lot since then. In 2006 the event was moved to Berlin and now extends over three days on 9,000 square meters in the Estrel Convention Center. Around 300 suppliers, including national mints and banks from around 50 countries, will be exhibiting their goods and services.

The event is particularly valuable for investors to get an overview of physical precious metals as an investment opportunity. The extensive offering at the fair includes international coins, limited editions, famous commemorative issues, special coins only available at the fair and a variety of other collectibles.

Diversification : While gold is a safe investment, investing all your money in gold is risky. Balance your portfolio with other forms of investment such as stocks, bonds and real estate.

Storage and Insurance : Invest in a safe deposit box to store your coins and consider getting insurance to protect against potential losses.

Regular Valuation : The gold market is not static. Prices fluctuate due to various geopolitical and economic factors. Keep an eye on market trends and periodically reassess your investment strategy.

Conclusion

Investing in gold coins is more than just buying the first shiny thing you see. They require careful planning, thorough research, and constant monitoring. By focusing on coin purity, recognisability, certification and grading, and buying them from trusted sources, you can develop a successful gold coin investment strategy.

Other interesting blogs:

Precious Metals: Care, Storage & Co.

The fascination of rare coins: Why they win the hearts of collectors and are a good investment

Discover the new additions to our gold coin collection in the current range!

-

Cuba – 1981 – 100 Pesos – Pinta – NGC MS68

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Santa Maria – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Nina – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 1993 – 1 oz Proof Gold Coin – NGC PF69 Ultra Cameo

3.300,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Mexico – 2010 – Libertad – Gold coin 1 oz – PCGS MS69

3.150,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2011 – Set – One of First 300 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2016 – Set – One of First 150 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2018 – Set – First Day of Issue – 6 Gold Coins Proof – NGC PF70 UCAM

5.750,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Bophuthatswana – 1987 – 10 years of independence – platinum – 1oz – with original case and certificate

2.195,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

South Africa – Krugerrand – GRC – 1990 – SAGCE PoV 100 – 1oz Proof Gold

3.250,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays)