RareCoin online store for rare coins

Sorting

Stock

Mexico – 2021 – Libertad – Gold Coin 1 oz Proof

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Mexico – 2019 – Libertad – Gold Coin 1 oz Proof

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Uruguay – 1987 – 5000 Nuevos Pesos – 20th Anniversary of the Central Bank – NGC PF67 UCAM

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Dominican Republic – 2017 – 70 Pesos – 70th Anniversary of the Central Bank – NGC PF70 UCAM

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Guatemala – 1971 – Revolution Centennial – Gold Medal – 0.81oz – NGC PF63 UCAM

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Krugerrand – 1967 Vintage – 50th Anniversary – 1oz Gold – NGC MS70 Deep Prooflike

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

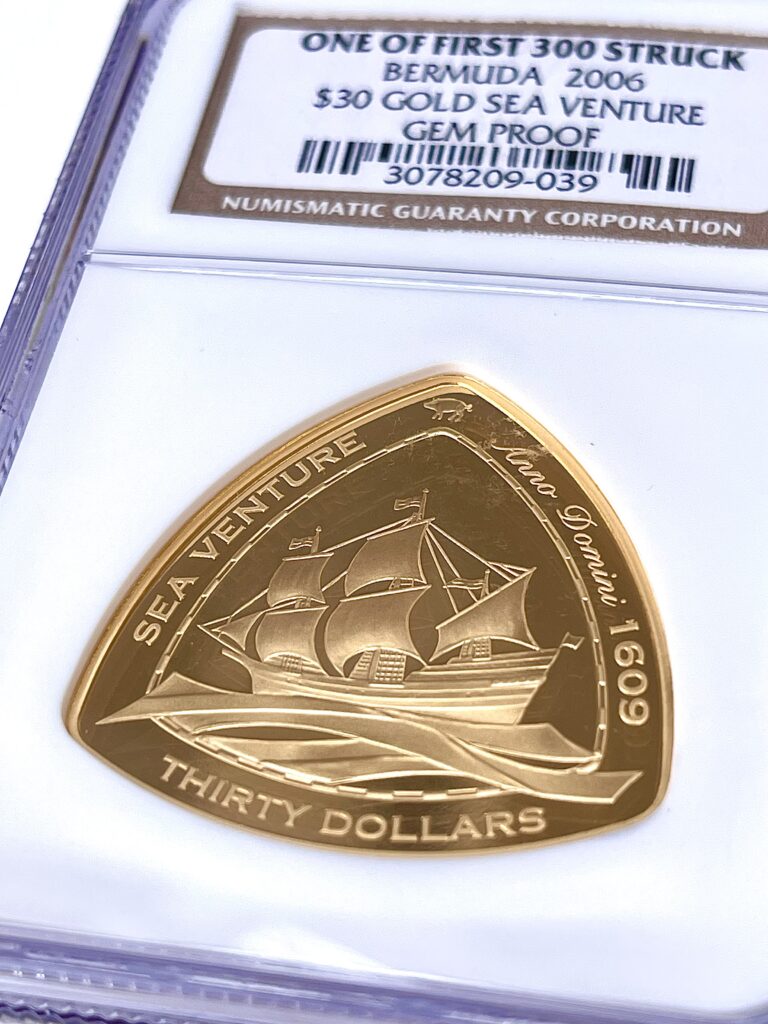

Bermuda – 2006 – 30 Dollars – Gold Sea Venture – NGC Gem Proof

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Iraq – 1980 – 100 Dinar President Saddam Hussein – NGC PF63 Cameo

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Tuvalu – 2021 – Black Flag – The Red Flag Fleet – First Strike – PCGS MS70

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Natura – 2011 – Meerkat – Kalahari Privy Mark – 1oz Gold Proof – NGC PF70 UCAM

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Natura – 2010 – Black Rhinoceros – EWT Privy Mark – 1oz Gold Proof – NGC PF70 UCAM

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Mexico – Libertad – 1981 – First Edition – 1oz Gold – PCGS MS65

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

UK – Mayflower 400th Anniversary – 2020 – 1oz Gold Proof – First Day of Issue – NGC PF70 Ultra Cameo

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Panama – 1976 – 500 Balboas – Birth of Balboa – 37.53g Gold Proof – First Day of Minting – NGC PF69 Ultra Cameo

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Ethiopia – 1966 – Hailé Selassié I – Golden Jubilee – 5 Coins Gold Proof Set – with box and original certificate of authenticity

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Somalia – 1965 – 5th Anniversary of Independence – 5 Coins Gold Proof Set – with Box and Original Certificate of Authenticity

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Tunisia – 1967 – 10th Anniversary of the Republic – 5 Coins Gold Proof Set – with Box and Original Certificate of Authenticity

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

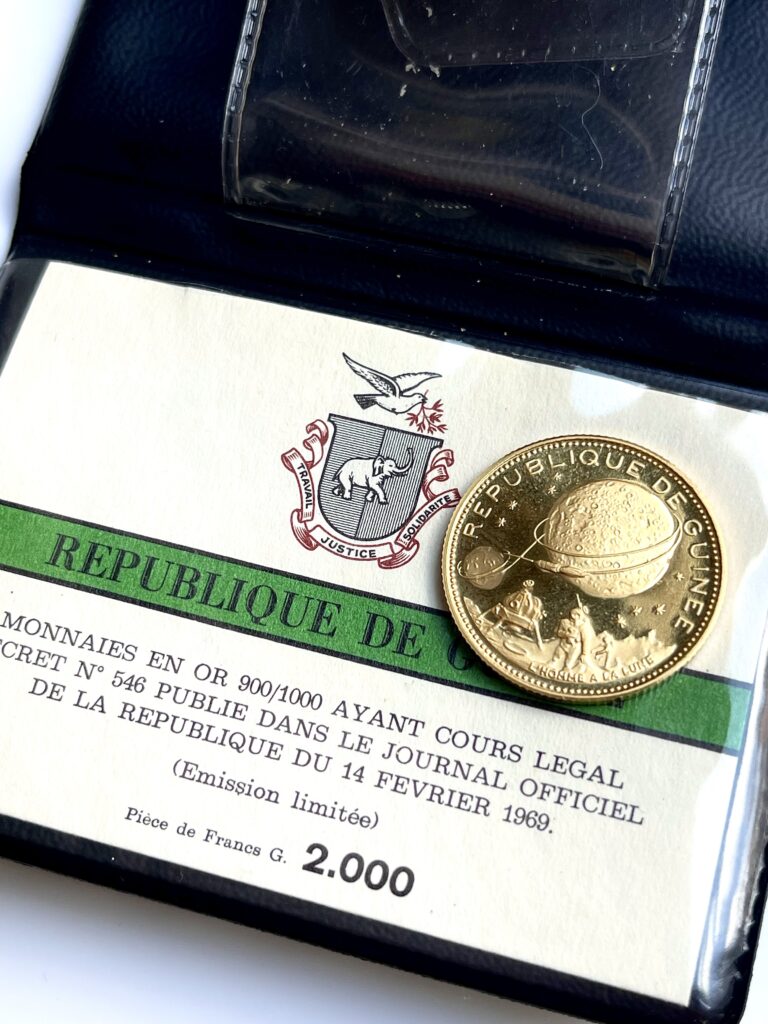

Guinea – 1969 – 2000 Francs – Moon landing

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Krugerrand – 1999 – Prestige Set – 4 gold coins Proof – Box and certificate

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Krugerrand – 2003 – Prestige Set – 4 gold coins Proof – Box and certificate

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Krugerrand – 2014 – Set – One of First 300 – 4 Gold Coins Proof – NGC PF70 UCAM

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Mexico – 2013 – Libertad – Gold Proof Set – 1.9oz – 5 gold coins – NGC PF70 UCAM

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Wedge-Tailed Eagle – 2021 – 1oz Gold – Enhanced Reverse Proof – First Day Issue – NGC PF70

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Barbados – 2017 – 5 Dollars – Trident – 1oz Proof Gold – NGC MS68

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

USA – American Buffalo Gold – 2008 – 4 Coins Proof Gold Set – Box and COA

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

USA – American Buffalo Gold – 2010 – 50 USD – 1oz Proof Gold – Box and COA

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Rhodesia – 1966 – 5 Pounds – Queen Elizabeth II – 36.59g – PCGS PR66

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

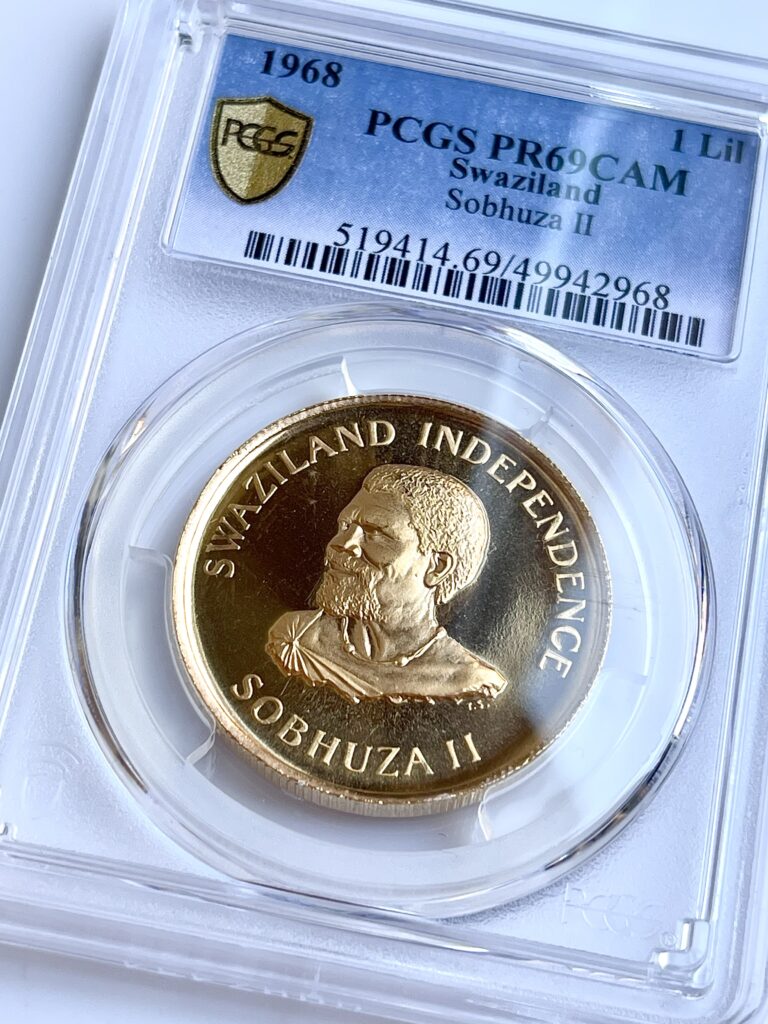

Swaziland – 1968 – 1 Lilangeni – Sobhuza II – Independence Issue – 1oz Gold Proof – PCGS PR69 CAM

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

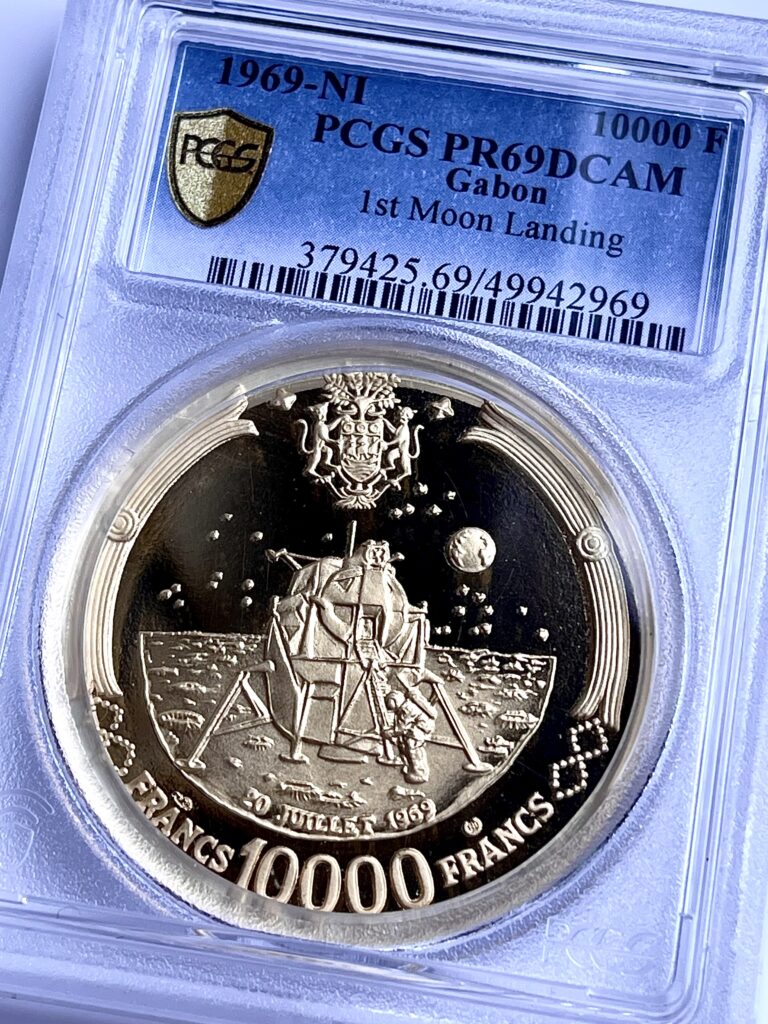

Gabon – 1969 – 10000 Francs – First Moon Landing – PCGS PR69 DCAM

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Liberia – 2000 – 100 Dollars – Liberty – Indian Head – Double Eagle Design – 1oz Proof Gold – PCGS PR69 DCAM

VAT exempt according to §25c USt

Sale without right of withdrawal (according to Section 6 General Terms and Conditions)

Buying coins: a wise investment

Numismatics, the world of coins, is a lot more diverse than most people think. Only eight euro coins are currently in circulation as bullion coins. By way of comparison, the number of collector and investment coins available worldwide is so large that it can hardly be quantified. And it is precisely these coins that fascinate professional numismatists as well as amateur collectors. But at the same time, more and more investors decide to buy coins. Because gold coins in particular are ideal as a long-term investment.

Buying and collecting coins: more than a hobby!

Millions of people around the globe share a passion for coins. And the fan base is growing day by day. Anyone who knows a little about numismatics is not surprised by the enthusiasm for this hobby. Because coins captivate not only in punco optics, but also

- tell story.

- expand general education.

- are a sensible investment strategy (because gold in particular is currently considered crisis-proof).

- connect people all over the world.

Bars or coins?

You want to buy gold, but you are not sure in which form? You can buy physical gold as gold bars or coins. In both cases, you initially rely on the material value of the shiny precious metal. This is based on the current share price performance. The spot price for gold and silver is set twice daily on the UK stock exchange, the London Bullion Market (LBMA) .

Good to know: The so-called sport price reflects the daily current of commodities, foreign exchange or shares. It differs from the forward price, which is based on future price developments.

Bar

Bars are minted or cast from pure precious metals, depending on their denomination.

As a rule, gold bars are marked with the following information:

- Fine weight

- Fineness

- Certificate of authenticity

- Embossing stamp

Unlike coins, bars do not have a motif side. The only exception are rare “motif bars”. The value of a gold bar depends exclusively on the price on the world market. Collectors of bars from specific mints or bar shapes are few and far between.

Coins

Coins also base their value on the daily price trend of the precious metal used. But this is only the basis of their value! Because this can be much higher due to the high demand for individual copies. Popular motifs, rare issues, current trends affect the price trend of coins, which have another advantage: Approved as legal tender , you can also use them to pay for goods in the event of a currency crisis. Admittedly, this is also possible with bars. However, because of their denomination, they are hardly suitable for the purchase of everyday products.

(Gold) coins as an investment: This speaks for it

Thus, we have already given you one reason to invest in coins made of silver or gold. But he is far from the only reason why more and more people buy rare coins.

If you are interested in a crisis-proof, long-term investment with a steady increase in value, you should go for gold. After all, a look at the past shows that gold does not lose value even in difficult economic times. Unlike paper money, it cannot be debased. On the contrary, the gold price usually even rises diametrically to falling share prices.

Another advantage is that gold is recognized around the globe and can be traded without any problems. This way you can have your coins appraised at any time and resell them at a suitable time.

In addition to gold, silver is also very popular with investors who want to buy coins. Those who are prepared to take a certain risk are also increasingly opting for coins made of platinum and palladium . All three precious metals are highly sought after in the processing industry due to their chemical and physical properties. The conductivity of silver, the corrosion resistance of platinum and palladium predestine these precious metals for future industries. This includes, for example, renewable energies or new drive options.

Collecting coins as a passion

Even if you purchased your first coins as part of your private investment strategy: You have to reckon with one problem. It is quite possible that you will not want to dispose of the beautiful coinage! Because coins score not only by their value. Above all, they are also visual beauties. At the same time, their motifs tell exciting stories from times past and present:

- Commemorative coins appear on certain occasions, such as birthdays of famous people or on the occasion of the Olympic Games. But there are also specimens that depict endangered species of animals or plants.

- As a coin collector, you can also dedicate yourself to a very specific theme. For example, a silver coin with the motif of a sailing ship fits perfectly into a collection on the theme of “seafaring”. Alternatively, you can also collect coins with different animal motifs.

Note: Precious coins are also ideal as an anniversary or confirmation gift. In the process, you can give gold or silver coins. But specimens made of other metals are also possible. In both cases, the chances are good that you will help the recipient to start a new hobby.

What are the coins?

Classic Krugerrand coins, modern gold-plated coins or silver coins: The world of coins is huge. Regardless of the motif or country of issue, coins can be divided into different categories. If you want to buy coins, you first have the choice between bullion coins and collector coins.

Investment vs. collector coins

Bullion coins are also called bullion coins, collector coins are also known as numismatic coins. The latter include commemorative coins, for example. They are all available in gold and silver, platinum and palladium, as well as alloys and colorations.

Bullion coins

Bullion coins are usually issued by the same country and mint for years and decades. The motif also changes only in exceptional cases. The stamped nominal value proves that the coins are official means of payment.

Note: The coin material alone usually exceeds the struck denomination many times over. Therefore, you should not use your bullion coins for payment.

Due to their durability, bullion coins are perfect for beginners in the world of coins. They are accepted worldwide and are primarily based on the value of the precious metal on the world market. However, despite their high mintages, the value of bullion coins can also increase disproportionately. How much your bullion coin is worth is also determined by the degree of preservation and the demand for the coin.

If you want to invest in bullion coins, you can buy, for example, Krugerrand coins. With the South African flagship, you are not only betting on one of the most popular bullion coins in the world, but also on the first coin ever minted – in 1967. Other popular bullion coins with appreciation potential include:

- the Maple Leaf of the Royal Canadian Mint

- the Vienna Philharmonic of the Austrian Mint

- the U.S. Buffalo

- the Kangaroo Nugget, the landmark of Australia

However, bullion coins do not always have to be coins made of gold: for example, you can also buy a silver China Panda coin, which also enjoys great popularity. In addition, it scores with another special feature: While the panda remains the same as the cover motif, the depiction of the animal changes from year to year.

Collector coins

Collector coins are always issued when you want to commemorate a particular event with a special edition. The periods of mintage are correspondingly short and the editions are usually limited accordingly. They are specifically intended for purchase by collectors and may not initially be suitable as an investment. This is because the material value is often initially lower than the purchase price. However, there may be significant increases in value over time. Because there are definitely collectible coins with which you can earn high profits.

To bet on the right specimens here, you should know something about the coin business. Experienced numismatists can often estimate which commemorative coins could still increase in value. Often among historical coins with a good state of preservation or from a particular year of minting are sought-after rarities. An example of this are old coins from Russia such as the well-known platinum ruble. After only a few years of minting in the 19th century, the coins were melted down again at that time. Except for a few copies. These have an enormous rarity value nowadays.

Note: Are you just discovering your passion for coins, but already want to invest in collector coins? Then you can turn to Rarecoin with confidence. With us you get only high quality and valuable coins. You can benefit from our many years of experience in the global coin business.

For overview once again summarized the different types of coins:

- Investment coins / bullion coins: Increase in value due to positive price trend on the precious metal exchange; ideal for beginners

- Collector coins: minted specifically for coin collectors; are characterized by special properties. Example: historical coins – history, commemorative coins – personalities and events; for experienced coin collectors.

Popular coins at a glance

In the case of both bullion coins and collector coins, particularly popular specimens have emerged over time. Among them are:

- The Krugerrand from South Africa in gold: this coin is traded as the best-selling in the whole world. The Krugerrand has lost none of its popularity even after more than 55 years. Unlike many gold coins from China, the gold content of the Krugerrand is only a good 90 percent. The remaining portion consists of copper. This gives the coin a special scratch resistance as well as a reddish glow.

- Among the most popular silver coins and gold coins from Australia is the kangaroo of the Perth Mint . Originally, a gold nugget adorned the bullion coin produced since 1986. After just four years, the nugget has been replaced by annually changing kangaroo motifs. The name “kangaroo nugget” helps distinguish it from later kangaroo series.

- I wonder if the American Gold Buffalo is so popular because of its exceptionally pure gold content of 999.9/1000? Quite possible. But also the motives could be the reason why so many investors choose this gold coin. The American Gold Buffalo depicts a Native American with feather ornament. The coin has been issued by the US Mint since 2006. The American Gold Buffalo is additionally published as a polished plate (300,000 pieces annually).

Palladium and platinum: a real alternative to gold coins

Torn between acquiring a globally popular bullion coin and that certain something? Then just combine your wishes!

- Platinum: This is possible, for example, with the Maple Leaf from the Royal Canadian Mint. In addition to gold and silver, the characteristic maple leaf has also been minted from pure platinum since 1988.

- Palladium: The ballerina from the former USSR enjoys great popularity among coin collectors from all over the world. Coins made of this precious metal are particularly rare and therefore basically in high demand. Alternatively, you can also look at the commemorative coin for the 20th anniversary of the fall of the Berlin Wall s This was minted in 2009 from palladium.

Buying coins: The best tips

Before you buy coins, you should consider what your goal is.

- Are you looking for a long-term, crisis-proof investment? Then you should look for investment coins made of pure gold or silver. It can also often be worthwhile to buy old coins and then resell them for a profit.

- Alternatively, just collect coins because you like them! Here you can specialize in one subject area. And maybe you would like to give the South African Big Five as a gift to your children? Animal motifs are particularly popular with children.

Tip: The 50-pesos gold coin from the Centenario family is one of the best-known gold coins from Mexico. It was first issued on the occasion of the country’s 100 years of independence back in 1921.

Where can you buy coins?

You have made your choice and want to buy palladium coins or coins from other precious metals? Then the next decision is up for grabs: Where should you buy your coins? Here you have several options open to you:

Classic bullion coins and German commemorative coins are usually available from the Bundesbank or savings banks. You have a larger selection at coin trading companies or private auction houses. If you like it especially convenient, you can also buy your coins online – for example here at Rarecoin.

Buy coins at RareCoin

At RareCoin you can not only buy coins. As coin specialists, we offer you numerous other services in addition to an extensive product range:

- Objective valuation and fair purchase of coins

- Support for coin search (Coin Hunting)

- Information on the current gold price

- Things to know about rare coins

- Certifications as additional security

- Answers to the most frequently asked questions

- Explanations of technical terms in the coin dictionary

Use the expertise of the Rarecoin team to successfully build your individual coin collection. Choose between the many valuable coins from different eras and materials.

Feel free to browse our website and contact us with any questions or suggestions. We are looking forward to meeting you!