In our increasingly unstable economic landscape, the need for stable, reliable investment options has never been greater. Stock markets are volatile, traditional savings accounts offer negligible interest rates, and even real estate is not immune to fluctuations. In this context, Krugerrand gold coins stand out as an investment that combines both stability and growth potential, making them particularly attractive to those planning for retirement. This article looks at the features that make the Krugerrand a reliable choice in these uncertain times.

Historical performance

The Krugerrand was first introduced by the South African Mint in 1967 and has a success story spanning over five decades. Its value is inextricably linked to the gold market, which has historically proven to be a stable and reliable investment. Even in times of economic downturn, wars and geopolitical instability, gold has maintained or even increased in value. Because the Krugerrand is a gold coin, it has this stability and can serve as a hedge against inflation and loss of value.- Liquidity and global recognition: One of the key benefits of investing in Krugerrand coins is their liquidity and global recognition. Since the Krugerrand is one of the most traded gold coins in the world, you can easily buy or sell it in almost any country. This global acceptance ensures that your investment is not just a piece of metal, but an internationally recognized currency.

- Minimal costs: Unlike other forms of gold investment, such as For example, exchange-traded gold funds or mining stocks, Krugerrands have no management fees or hidden costs. The coin you hold represents the full extent of your investment, giving you transparency and control over your financial future.

- Tangibility: At a time when digital assets can disappear due to hacker attacks or technological problems, the tangibility of Krugerrands provides psychological comfort. Owning a physical asset can be satisfying and reassuring, especially when other assets are intangible and subject to digital risks.

Saving for retirement

For those considering retirement planning, the Krugerrand offers several distinct advantages:

- Long-term stability : Due to its history and intrinsic value, the Krugerrand is likely to remain stable or increase in value over time, providing a secure nest egg for your retirement.

- Diversification : Including Krugerrands in your retirement portfolio can be an element of diversification and reduce the risk associated with putting all your eggs in one basket.

- Hedging against inflation : Given the aggressive monetary policies of central banks around the world, the risk of inflation is higher than ever. Gold has always been an effective hedge against inflation, making the Krugerrand a prudent choice.

Bullion vs. Proof Krugerrand: Which is the better investment?

When it comes to investing in Krugerrands, investors face the dilemma of whether to choose bullion coins or proof coins. Both types of coins have their own advantages and disadvantages, and the decision ultimately depends on your investment goals.

Krugerrand bullion coins

Bullion Krugerrand coins are primarily tied to the market value of gold. Their value increases in step with the price of gold and offers an uncomplicated and relatively stable investment opportunity. These coins are ideal for investors looking for a long-term investment that serves as a hedge against economic instability and inflation.

Benefits

- Liquidity : Easier to sell at market value.

- Stability : Tied to the gold market, which is historically a stable asset.

- Lower Premium : Typically bought and sold at a lower premium over the spot price of gold.

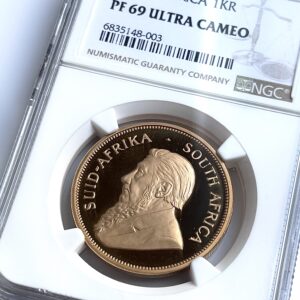

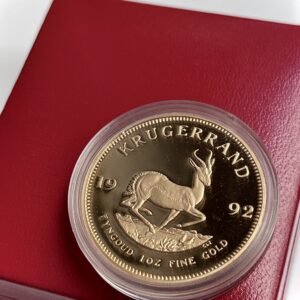

Krugerrand proof coins

Proof Krugerrand coins are special coins that are more finely crafted and are released in limited editions. These coins are often the target of collectors and can command a much higher price than their gold bullion counterparts due to their rarity, demand and popularity.

Benefits

- Rarity : Limited editions can drive up demand and value.

- Collectible : High aesthetics and craftsmanship can make them more desirable.

- Potential for Higher Yields : Due to their rarity and collector demand, they can sometimes yield higher returns than bullion coins.

So which is better: bullion coins or proof coins?

- Stability and liquidity : If you value stability and liquidity, bullion coins are the best choice. They provide a direct relationship to the market price of gold and are easier to sell quickly.

- For growth and potentially high returns : If you are willing to take more risk for the chance of higher returns and have an interest in numismatic value, proof coins may be more attractive. They offer the potential for higher profits due to their rarity and demand among collectors.

In summary, both bullion and proof Krugerrand coins have their advantages. Bullion coins offer a safe but relatively modest return on investment based on the value of the gold. Proof coins, on the other hand, offer the chance of significantly higher returns due to their limited availability and higher demand, but are associated with higher premiums and are less liquid than bullion coins. Choose depending on your investment goals and risk tolerance.

When people consider investing in Krugerrand gold coins, in addition to choosing between bullion coins and proof coins, they often have a number of questions to ensure they are making a wise financial decision. Here are some typical questions potential buyers may ask:

Authenticity and quality

- How can I check the authenticity of the Krugerrand?

- What is the purity and weight of the coin in gold?

- Is the coin newly minted or previously owned?

- What is the coin’s value and has it been professionally graded by a reputable organization?

Pricing and costs

- What is the current price of the Krugerrand and how closely is it related to the current gold spot price?

- Are there any additional surcharges or fees?

- How does the price compare to other types of gold investments, such as bars or other gold coins?

procurement

- Can I see the certificate of authenticity and does it come with the original packaging?

Liquidity and Resale

- How easy is it to sell the coin later?

- What return can I expect on resale?

Investment strategy

- What are the tax implications of investing in Krugerrands?

- How does the Krugerrand compare to other gold coins such as American Eagles or Canadian Maple Leafs from an investment perspective?

Diversification and portfolio

- How can the Krugerrand be integrated into my overall investment portfolio?

- How do Krugerrand coins behave in times of economic uncertainty?

- Should I consider diversifying my Krugerrand investment with other types of assets?

Purchase and delivery

- How does the purchase work?

- How is the coin delivered and is it insured during shipping?

- Which payment methods are accepted?

Getting answers to these questions will help you feel more confident about your investment and better understand the potential advantages and disadvantages of adding Krugerrand to your portfolio. You can find answers to many of these questions in our blogs.

If you are considering purchasing Krugerrand gold coins, there are additional factors that could influence your decision and improve your investment strategy. Here are some of them:

Market timing

- Gold price fluctuations : Keep an eye on the global gold market, especially if you focus on bullion coins. Prices may fluctuate based on economic indicators, geopolitical tensions and currency valuations.

- Buy low, sell high : This is the basic idea of every investment. Track historical gold and Krugerrand prices to find the best time to buy.

Storage and security

- Safe deposit box or home safe : Decide where you want to store your Krugerrand. Some people choose a bank safe deposit box, others prefer a safe at home.

- Insurance : Make sure your coins are insured for their full replacement value.

quantity and species

- Bulk Buying : Sometimes retailers offer a discounted price if you buy in bulk. Team up with friends or family to get volume discounts.

- Bullion vs. Proof: Decide whether you are interested in gold bars, which are more tied to the value of gold, or proof Krugerrands, which can have additional value due to their rarity and demand.

Duty of care

- Dealer Reputation : Make sure you buy from a reputable dealer. Look for reviews, testimonials, and ratings from established organizations.

- Certificates and Documents : Make sure your Krugerrand Proof coins come with all necessary certificates and documents proving their authenticity, as well as the original box from the SA Mint.

Exit strategy

- Resale Value : Research the resale market for Krugerrands. You should know where to sell them and what prices you can expect.

- Condition of Coins : Keep in mind that resale value can be affected by the condition of the coin, especially if it is a Proof coin. Always handle coins with care and it is best to keep them in their protective packaging. Do not take them out of the capsule, and if you really have to do it, do it with protective gloves.

Tax implications

- Inheritance and gift taxes: If you intend to pass on the coins as a family heirloom, you should be aware of possible inheritance or gift taxes.

Diversification

- Other Investments : Krugerrand coins are just one way to invest in gold or diversify your portfolio. For a balanced investment strategy, you should also consider other options such as stocks, bonds or other precious metals.

By considering these factors, you can make a more informed decision when investing in Krugerrand gold coins and optimize your investment for both short-term and long-term benefits.

And finally… what is the “best” size of Krugerrand to buy?

The “best” size of Krugerrand coins depends on various factors, such as: B. Your investment goals, your budget and how you want to store the coins. Krugerrand coins come in a variety of sizes, from 1/50th of an ounce to a full ounce. Below are some points to keep in mind for each size:

1 ounce (1 oz) Krugerrand

- Pros : These are the most popular and widely traded Krugerrand coins. They often have a smaller premium over the spot price of gold and offer better value for money.

- Considerations : A 1-ounce coin is more expensive than fractional pieces, so you’ll need to invest a larger amount of money upfront. You’ll also need a safe place to store these larger coins, either a bank safe deposit box or a well-secured safe at home.

Fractional Krugerrand coins (1/2 ounce, 1/4 ounce, 1/10 ounce, 1/20 ounce and the recently introduced 1/50 ounce)

- Pros : These coins are more affordable and easier to trade in smaller quantities. They are a good option for people with limited investment capital or for those who want to give them as gifts.

- Considerations : The smaller the coin, the higher the premium you will pay over the spot price of gold. While they are cheaper, they may not be as cost effective as a full ounce coin.

General considerations

- Liquidity : Larger coins tend to have better liquidity, meaning they are easier to sell quickly.

- Storage : Smaller coins are easier to store, especially if you have limited space or don’t have a secure storage area.

- Diversification : Buying different sizes gives you more flexibility when it comes time to sell. You can sell smaller quantities if necessary without having to dissolve an entire ounce.

- Purpose : If you are purchasing the coins primarily as a long-term investment, larger formats tend to offer greater value. If you are purchasing the coins as a gift or out of curiosity about owning gold, the smaller sizes are often more practical.

- Market Conditions : Sometimes certain sizes become more popular due to economic conditions. By keeping an eye on the market, you can determine what size is currently in demand.

- Local Availability : Depending on where you live, certain sizes may be more readily available than others.

- Investment Goals : Your own investment strategy and financial situation play an important role in deciding which size is best for you.

- Budget : Ultimately, your available budget will be a determining factor in the size of Krugerrand you can afford.

By carefully weighing these factors, you can determine which size Krugerrand best suits your investment portfolio.

Conclusion

In the face of economic uncertainty, volatile stock markets and low-interest traditional savings accounts, Krugerrand gold coins offer a compelling alternative that combines the benefits of stability, liquidity and potential for appreciation. With a history spanning over five decades, this South African coin has proven to be a reliable hedge against economic downturns and inflation. Their intrinsic value is undeniable and tied to the timeless value of gold. In addition, their global popularity guarantees liquidity, while their physical form provides a sense of security that is missing from digital assets.

Whether you are an experienced investor or want to build up retirement savings, Krugerrand offers you a double advantage. On the one hand, Krugerrand bars are a stable, uncomplicated investment that is tied to the gold market. On the other hand, Proof Krugerrands, with their limited editions and collectible value, offer the possibility of higher returns, albeit with higher risk and lower liquidity. Choosing between these two types depends on your financial goals, risk tolerance, and investment strategy.

Potential buyers would do well to conduct due diligence, considering factors such as the dealer’s reputation, the authenticity of the coin, and long-term storage options. When considering which Krugerrand size is best, you should balance your decision with your financial capabilities, investment goals and storage options. From the full ounce coins that offer lower premiums to the fractional coins that are affordable, each has its own advantages and disadvantages that must be carefully considered.

Finally, it is worth remembering that while the Krugerrand offers a solid investment opportunity, diversification remains the key to wealth management. These gold coins should ideally be part of a diversified portfolio that can also include other asset classes such as stocks, bonds or real estate.

In conclusion, investing in Krugerrand gold coins is not just about acquiring a piece of metal. It’s about securing a stable, globally recognized and liquid asset with a proven track record. It’s a tangible piece of security in a digital world, a golden key to financial stability and potentially a prosperous retirement.

Perhaps also interesting: Is gold as good as money and what are the reasons for investing in physical gold? Krugerrand – Silver coins – Gold coins – Platinum coins The advantages of buying platinum coinsDiscover the new additions to our Krugerrand gold coin collection in the current range!

-

Krugerrand – 1993 – 1 oz Proof Gold Coin – NGC PF69 Ultra Cameo

3.300,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2011 – Set – One of First 300 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2016 – Set – One of First 150 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2018 – Set – First Day of Issue – 6 Gold Coins Proof – NGC PF70 UCAM

5.750,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

South Africa – Krugerrand – GRC – 1990 – SAGCE PoV 100 – 1oz Proof Gold

3.250,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

South Africa – Krugerrand – GRC – 1989 – SAGCE PoV 100 – 1oz Proof Gold

3.250,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

South Africa – Krugerrand – 1992 – 1oz gold coin proof with box

5.750,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

South Africa – 2020 – Rhino – Big Five Series I – 1 oz Gold Proof

4.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

South Africa – 2021 – Buffalo – Big Five Series I – 1 oz Gold – Proof

4.250,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

South Africa – Krugerrand – 1 oz Platinum Proof – 2017 – 50th Anniversary – NGC PF69 UCAM

3.795,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays)