Gold coins have been one of the most popular means of payment for many hundreds of years. Until the Gold money was in active circulation throughout the 19th century. Even more, in the In the 19th century, a large number of gold coins were minted in practically all countries of the world, since at that time the gold standard was introduced, which made gold the only common currency. At 20th century, gold coins quickly disappeared from circulation, making way for paper money. However, it would be strange if gold coins disappeared altogether. Thousands of years of monetary history are hard to wipe away.

A centuries-long passion and love for gold continues

Nowadays gold coins are still minted, but now they serve more as investments. Investing money in gold coins is good for the wallet and extremely interesting from a collector’s point of view. The coins of the last few years are also already history and these too will probably increase in value every year.

In addition to gold, other precious metals such as platinum, palladium and silver are also used for financial investments. However, the gold pieces are particularly popular, and worldwide. Mankind’s age-old passion for gold has never been surpassed by any other metal.

Although bullion coins have a face value (for example, 100 pesos, 200 rubles, 100 dollars, etc.), it is unlikely that anyone will pay with them in a store. These coins are simply not intended for circulation. They move from collection to collection, where they are actually purchased, exchanged or stored.

Gold coins collections and investments

National/central banks issue bullion coins. Precious metal commemorative coins and collector coins are also often bought as an investment. Commemorative coins or collector coins are not primarily aimed at investors, but collectors, which is why they are very beautifully designed. Some of them are real works of art! The beauty of a coin is also an investment that pays off many times over. In addition, the value of coins is increased by their historical value.

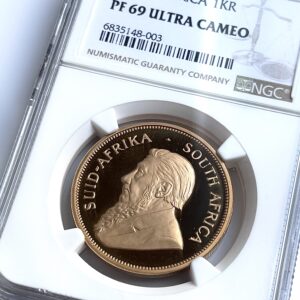

Some gold coins may start out as bullion coins rather than collectible coins, but become such. One example is the Krugerrand from 1967. There were 40,000 bullion coins minted in 1967. Today, these coins are a true rarity and hardly available on the market. Read more about it here: https://rarecoinv4.wpengine.com/blog/von-1967-bis-heute-fragen-und-answeren-zum-thema-kruegerrand/

However, there are also gold investment coins, which are used to invest money in the expectation of positive performance of the precious metal. They are minted as uncirculated coins. Their design is more modest than the collector’s editions. But their circulation is much higher. A few examples for comparison:

- Gold Krugerrand 1 Ounce PP (Proof/Polished Plate) – 1978 -edition: 10,000 pieces

- Gold Krugerrand 1 ounce 1978 – bullion coin – mintage: 6,022,293 pieces

- Gold Krugerrand 1 Ounce PP (Proof/Polished Plate) – 2008 -edition: 2243 pieces

- Gold Krugerrand 1 Ounce 2008 – Bullion coin – Mintage: 743,476 pieces

Expensive beauty worth

Nowadays, there are a variety of gold coins for investors and collections. Among them there are worldwide known, popular and accessible series, but of course also rare variants, which are intended not only as a profitable investment, but to acquire a coveted rarity for a collection.

One of the first gold coins to be issued as bullion coins was the South African Krugerrand. They were named after Paul Kruger, who became a national hero through his confrontation with Great Britain, which wanted to conquer the Republic. The minting of the Krugerrand began in 1967. They were issued in large numbers (in 1967 – 50,000 pieces – mintings). But such bullion coins are not cheap – on August 22, 2022 they cost from about 1,779.39 EUR each. The coin contains 2.826 grams of copper and 1.09 ounces of pure gold, which gives the Krugerrand its characteristic reddish hue.

Interestingly, there are more Krugerrand coins in the hands of the U.S. population than American gold eagles (known as “AmericanEagle”), which are their own bullion coins.

China’s gold pandas (also known as “(Gold) China Panda“) are among the illustrious group of the world’s most volatile bullion coins. The design of the coins changes every year, although the obverse with the image of the Temple of Heaven has remained unchanged since 1992. The China Pandas on the back are different every year except 2001 and 2002.

The gold coin Australian Kangaroo, also known as Kangaroo or formerly Nugget, come from Australia and are also popular worldwide. This coin is “unadulterated” because it is enclosed in a special capsule that cannot be tampered with. The gold coins were packaged in a square coin capsule until 1999 and in a round coin capsule from 2000. It can therefore change hands without any problems and remains untouched. For example, in the case of proof-quality collector coins (not bullion coins), this is critical, and any imperfection can reduce the value of the coin to the low price of the metal.

The Canadian bullion coin (known as theMapleLeaf) with a maple leaf on the reverse and an image of Queen Elizabeth on the obverse is considered the purest of its kind (0.9999 proof) and the most impeccable minting quality. The coin has been minted since 1979. Many money investors around the world choose the Canadian Maple Leaf Gold as an investment target.

In terms of price, the Austrian gold coin “

Vienna Philharmonic

” similar to the Maple Leaf. For gold investments, a selection of €4, €10, €25, €50 and €100 is issued each year. Money investors investing in platinum are offered € 4 and € 100. A nominal value of 1.5 euros is envisaged for silver. 100 euros correspond to one ounce = 31.1 grams.

The “

Britannia

” is minted at the Royal Mint of the United Kingdom. The motif of Britannia stands as a symbol of the United Kingdom.

Originally, the Britannia was minted in 22-karat gold (0.917 proof), but in 2013 the Royal Mint changed the fineness to 0.9999 to make it more competitive with other gold bullion coins.

Why buying gold coins is a good investment

At the time when many investment seems so uncertain, is it really worth buying gold coins? Any reputable gold coin dealer will tell you: “As with other investments, there is no (!) guarantee that you will make money. Nevertheless, numerous money investors have had success with the purchase of gold coins. Especially it concerns those who sell part of their assets when it is profitable. It is important to note that owning physical gold should not be considered only as an investment. Rather, it is a commodity that is seen more as “insurance” against inflation and difficult economic times. Gold usually retains its value because it is not pegged to a national currency.

Types coins

Gold coins come in different shapes and sizes. There is a niche market for both historical or collector coins, as well as investment gold coins minted specifically for today’s investors. The range of weight and size of old gold coins is almost limitless. In contrast, the variety of bullion coins produced today is somewhat less.

The selection of modern gold coins on the market ensures that everyone can find a suitable option. The most commonly available weights belong to the following categories:

- 1/25 oz

- 1/20 oz

- 1/10 oz

- 1/4 oz

- 1/2 oz

- 1 oz.

The weight of modern bullion coins is measured either in troy ounces or in grams, regardless of the country of origin. Standardization of weight and fineness makes it easy for investors to keep track of their gold holdings.

Is buying gold coins costly?

Many types of investments involve mountains of paperwork. Buying a property can become a headache that lasts weeks or even months. Stocks, cars and other popular investments are also time-consuming and involve a lot of paperwork.

Buying a gold coin is as easy as buying a book or household items in a local store or online. This is exactly one of the attractive features: Simplicity and no extra costs for brokers, notaries, care/maintenance, etc. Many gold coin dealers accept payment methods such as cash, credit cards, bank transfers, Paypal, etc.

Where to buy gold coins?

There are several ways to buy gold coins:

- Reputable precious metal dealers/specialists

- Trade exhibitions or events, congresses where traders come together

- Auction houses

- personal contacts (Ebay or similar platforms)

When buying gold coins, please note that it is better to buy gold coins from proven dealers – online as well as in person.

Unfortunately, many people try to save money and buy coins from exchanges or contacts they met somewhere.

The sad reality is that many people who buy gold coins very cheaply end up being scammed and left with gilded base metal fakes. And these buyers have no way out because the seller disappears and can not be found.

At RareCoin you buy gold coins in best quality, at very fair prices and of course with secure shipping within Germany and also worldwide. Do you have any questions? Feel free to contact us for a personal consultation on the phone or via Zoom/Teams.

Discover the new additions to our gold coin collection in the current range!

-

Cuba – 1981 – 100 Pesos – Pinta – NGC MS68

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Santa Maria – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Nina – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 1993 – 1 oz Proof Gold Coin – NGC PF69 Ultra Cameo

3.300,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Mexico – 2010 – Libertad – Gold coin 1 oz – PCGS MS69

3.150,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2011 – Set – One of First 300 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2016 – Set – One of First 150 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2018 – Set – First Day of Issue – 6 Gold Coins Proof – NGC PF70 UCAM

5.750,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays)