Those who want to protect and increase their assets should position themselves as broadly as possible financially. This approach is not a new strategy in asset management, but invokes a millennia-old rule. By dividing your assets between different investment areas, you reduce potential risks. The idea behind the so-called “three-spoke rule” therefore still holds true: because on the one hand it minimizes financial risk, while at the same time it can contribute to considerable gains. However, for this investment technique to work, a basic understanding of the strategy behind it is necessary. In this article, you will learn what the tried-and-tested 3-spoke rule is all about, which three pillars the rule is based on, and how to invest your assets sensibly and broadly.

What is the three-spoke rule?

The so-called three-spoke rule originated several thousand years ago. It was first mentioned by Rabbi Isaac Bar Aha in 400 AD. It is therefore a tried and tested investment strategy that has lost none of its validity to this day. The financial concept is based on a simple basic principle, namely the division of private assets into three independent areas.

The model goes back to a wheel with three spokes, which visualizes this simple approach excellently. Each individual spoke stands for a specific type of investment. Originally, the three spokes symbolized the areas Land, merchandise and cash. Today, the old approach can easily be transferred to the modern investment world. Because although stocks and mutual funds didn’t exist at the time, the three-spoke rule is still relevant today – only the areas in which you can invest have changed. So nowadays you can buy gold coins instead (for example, here at Rarecoin), buy real estate, and invest in stocks. This gives you a broad base in the financial world. As an investor, you are always pursuing the goal of distributing your assets in a risk-adjusted manner . In order for this to succeed, the three areas should allow as little overlap as possible .

Info:

The three-spoke rule is not a rigid investment model, however, but is highly mutable. If the market situation changes, you should therefore adapt your three-spoke strategy to the new circumstances, for example by rethinking the weighting of the individual areas. Such considerations are indispensable when applying the 3-spoke rule. This is the only way to prevent an unequal distribution of your assets. As simple as the principle is to understand, in practice it can be complicated to optimally adjust one’s own investment strategy to the respective fiscal situation.

Although the basic principle of the three-spoke rule is still valid, the first question is: How can the three traditional areas of “land,” “trade goods” and “cash assets” be applied to a modern financial context? The answer to this is relatively simple:

Land:

This investment area has changed little over time. As before, this includes all assets based on real estate, but also land, forests or agricultural land can be subsumed under the term “land”.

Trade goods

: While spices, silk and tea used to be good hedges, users of the three-spoke rule now focus on other aspects. In particular, securities (such as shares and funds) are now the focus of this investment area.

Cash on hand:

Besides accumulating cash , you have other ways to invest in this area. These include precious metals in particular. Besides platinum and silver , you can also buy gold coins. Especially rare coins like the old Spanish gold coin or the Venetian gold coin are a profitable and safe investment.

If they consider the three-spoke rule in investing, your assets are always sufficiently diversified. In the further course, each individual spoke ideally achieves a steady gain. If losses occur in one area despite all precautions, it is sufficient to specifically reconsider this one spoke. This makes the three-spoke rule not only particularly safe, but also suitable for everyday use.

Important:

Despite all the above advantages, the three-spoke rule is not a path to fast money. Rather, when you use the rule for your investment, you benefit from a proven, long-term investment concept. These are therefore by no means quick investment opportunities that you can discard again within a very short time. Achieving long-term benefits and profits requires both a sensible strategy and a certain amount of time. It is important to take general economic fluctuations into account.

These are the 3 pillars of prosperity and financial independence

The three-spoke rule has been in place for more than 1,600 years. In order for you to benefit from this method in the long term, it is important to have the right investment strategy. As the name suggests, it is a strategy based on three central pillars. These so-called spokes are:

- Shares and funds

- Real Estate

- Gold, silver and other precious metals.

By basing your assets on three pillars, you spread the risk and can make profits. This is also one of the reasons why the rule has stood the test of time. In the best case, all three types of investments should contribute to profit. That is why, for example, it does not make sense to invest exclusively in precious metals.

However, the Three Spokes Rule not only enables you to safeguard your assets: it is a key building block for prosperity and your financial independence. This is not least because you do not have to worry if fluctuations appear in one area. Although action is required in such a situation, you are not dependent on this single pillar for your existence. The result: you remain financially independent in any case. Without such an investment strategy, small events and economic swings can quickly have drastic consequences for your economic circumstances. For example, if you only have cash assets or real estate, the uncertainty increases and you always feel tied down. After all, there are too many factors that can affect each individual sector. Diversification, on the other hand, helps you make the necessary arrangements.

Spoke 1: Real estate for safety

Real estate in well-located areas is steadily increasing in value. After all, there is always a demand for housing, regardless of the economic situation. In addition, land is a limited resource that cannot be multiplied so easily. This results in a steady increase in the value of your property. Of course, this always involves a certain amount of effort, but this can almost always be delegated. In order for the property to generate the best possible profit, its location is crucial. Both prime locations within cities and offbeat places are in demand. Such special properties are an excellent capital investment and at the same time an ideal personal retirement provision.

Despite the positive features, investing in real estate also has its disadvantages. This is because it is an undynamic financial product that can lose value under given circumstances. Natural disasters, crises or social changes can lead to a decline in demand. Improper handling of the property also leads to loss of value. For this reason, it is necessary to consider the other two spokes of the three spokes rule as well.

Spoke 2: Shares and securities replace merchandise

Investing in stocks and securities is not always easy. In order to be able to make profits here, a certain amount of financial know-how is required. These professional skills require constant exposure to this subject matter. Working people in particular therefore benefit from the expertise of banks and investment advisors. They have sufficient knowledge in this area. Therefore, investing in stocks cannot be compared to buying gold coins or other tangible assets. For gold coins, the value is largely. This is because the gold price is less subject to economic fluctuations.

Unlike shares, funds offer you the advantage of achieving a wide spread. This is because they bundle many different securities, which also helps to minimize risk. Combined with bonds, you thus benefit from falling interest rates and high price gains as well as a certain stability in times of crisis. Companies you invest in are evolving day by day. Particularly in the case of shares and securities, it can therefore make sense to regularly adjust your investment strategy.

Spoke 3: Precious metals as a stable investment

Since time immemorial, gold and silver have had the same value as money. Although they can not count on high interest rates with this investment, but gold coins maintain the value of your investment in the long term. Investing in Degussa gold coins or a special old Spanish gold coin can therefore be worthwhile. Such investment opportunities are just as much a part of the three-spoke rule as asset accumulation with the help of real estate and securities.

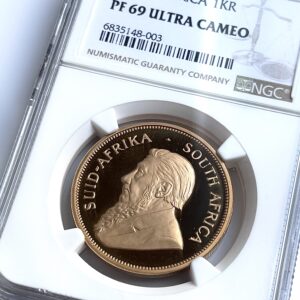

Gold coins in Germany are also particularly attractive because of their tax-free growth after one year. Besides gold coins, gold barsmay also be of interest to you. Large bars are usually cheaper. The fact that the prices for gold coins are higher is mainly due to the minting costs. Fancy specimens like the former gold coin of the USA (the Eagle), an old Spanish gold coin or the Krugerrand gold coin are particularly popular. They are not only a safe investment opportunity, but also enjoy great popularity among collectors and enthusiasts.

Another advantage of precious metals is their affordability: While not everyone is in a position to invest in particularly expensive, rare collectibles, there are also more common gold coins. After all, how high the prices for gold coins ultimately turn out to be depends heavily on their age as well as their availability.

Although gold coins are worth a lot, you can also choose other precious metals. Platinum or silver are also excellent ways to stabilize and expand the third spoke.

The three-spoke rule: a millennia-old principle – more relevant than ever before

The three-spoke rule remains a sound principle that protects your assets from risk. It is no secret that the financial world is becoming increasingly turbulent. This makes it all the more dangerous to make investments exclusively in a single area. Economic crises or a pandemic can have immense effects within a few days. The stock market in particular is extremely unstable in such times. This makes it all the more important to rely on a well thought-out investment strategy such as the three-spoke rule. This way, even in the event that one of your investments fluctuates for a short period of time, you don’t have to worry about losing all of your assets.

Accordingly, the three-spoke rule is much more than a “classic” investment strategy. The fact that the proven rule still works today has several reasons. Thus, it stands for diversification of your assets. At the same time, the method is still flexible and in no way requires an exact division into three parts. Far more important is that you keep an eye on the market and spread the risks as well as possible. Nevertheless, this form of investment has proven its worth.

Value retention is also an important point of the three-spoke rule. To ensure this, investment in tangible assets is necessary. Since the 3-spoke rule does not target specific numbers, it is in principle suitable for all investors. Even if you do not own any real estate yet, you can alternatively buy gold coins, for example – and consider them as a first investment in this area. The Corona pandemic has already shown that physical gold coin prices were well above those of the markets. The same applies to silver, platinum and palladium. The fact that this is true despite falling prices on the commodities market is due to the value of precious metals. But what does that mean? In times of crisis, a large proportion of people are more willing to pay a higher price. As a result, gold coins, for example, increase in value. Those who wish to sell their gold coins at such a time will benefit from the fact that gold coins fetch prices that were previously unthinkable.

History shows time and again how vulnerable the monetary value sector is. Fluctuations regularly cause nervousness among investors. To be on the safe side in the long run, a thoughtful method like the three-spoke rule should protect your investment. As a safe investment model, it has already proven itself for more than a thousand years.

By the way:

Although the three-spoke rule is based on three different pillars, it is a model suitable for everyday use. You don’t have to invest in all three areas right away. However, it is important that you do not invest immense sums in a single investment area. If you cannot or do not want to buy real estate at the moment, you can opt for precious metals, for example. Investment in funds or shares can also be realized with different financial means. However, for a portfolio that is as strong and crisis-proof as possible, you should pay attention to risk allocation according to the three-spoke rule.

Gold coins as an investment: That’s why it pays to invest in gold

Gold coins or gold bars are tangible assets that can sustainably support your wealth. The big advantage for you is that fluctuations on the stock market have hardly any influence on this. Of course, fluctuations also occur in the field of precious metals – nevertheless, they are an ideal investment opportunity in the long term.

First and foremost, demand influences the price of gold. The higher the demand, the higher the price rises. This means that if there is a high demand, then you will generate higher income if you sell gold coins, for example. This applies to valuable collector’s items such as the Degussa gold coins, the Venetian gold coin or the former gold coin of the USA just as it does to less expensive coins. After all, there is no internal development in gold or silver, as is the case with companies.

Gold coins: A tangible asset with many advantages

Investing in gold coins remains a popular investment strategy in this country as well. The reason for this are different advantages that gold offers you as a tangible asset:

- Gold reserves are limited worldwide. Even if demand increases, resources remain limited. In the short term, increased buying interest can be solved by recycling old stock – but not in the long term. If demand continues to rise, prices will be particularly high. At such a time it is extremely profitable to sell gold coins.

- Gold does not lose its value. Fluctuations may influence the exact value. However, it is very unlikely that precious metals will completely lose value at some point. This means you don’t have to sell your coins at the first fluctuations. As soon as demand rises again, they regain value.

- Silver and gold are means of payment that have enjoyed centuries of acceptance Rare and old gold coins in particular are very popular with collectors. Although they can no longer be used as a means of payment, their rarity makes them a sought-after commodity.

- The value of gold often moves in the opposite direction to the stock market. By investing in gold, you thus effectively counter fluctuations in your portfolio. Nevertheless, these are different aspects of the three-spoke rule. Conversely, this means that it is necessary to counteract these fluctuations with the help of the other areas.

There is a saying that people who have gold always have money. In fact, it always makes sense to add precious metals to your portfolio. In addition, however, do not neglect the other investment areas in any case. Diversification is an important step toward financial independence and securing your finances.

You should combine gold with other forms of investment

Investing in gold bars, gold coins (such as the Krugerrand gold coin) offers you numerous advantages. However, if you invest your assets exclusively in precious metals, you will miss out on important income that can help you grow your finances. You should therefore always supplement this value protection with the other two spokes. Only in combination can all elements of your portfolio unfold their potential and secure your finances all around.

The returns, interest and income you gain from stocks, funds and real estate increase your financial independence. In the long term, this means you can continue to expand your investment opportunities and not rely on a single sector. If the price of gold drops rapidly, you do not have to sell your gold coins immediately: By taking the three-spoke rule into account, you have far better options to compensate for this temporary loss.

Did the information on the “three-spoke rule” help you? Then we have more interesting articles on the topic of gold for you:

Discover the new additions to our gold coin collection in the current range!

-

Cuba – 1981 – 100 Pesos – Pinta – NGC MS68

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Santa Maria – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Nina – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 1993 – 1 oz Proof Gold Coin – NGC PF69 Ultra Cameo

3.300,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Mexico – 2010 – Libertad – Gold coin 1 oz – PCGS MS69

3.150,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2011 – Set – One of First 300 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2016 – Set – One of First 150 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2018 – Set – First Day of Issue – 6 Gold Coins Proof – NGC PF70 UCAM

5.750,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays)