Rare coins are a fascinating subject, not only for numismatists who study them, but also for investors and collectors worldwide. These coins are often historically significant, artistically valuable, and only circulate in limited numbers, making them desirable pieces. But what exactly makes a “rare” coin, how popular are they with collectors worldwide, and why invest in them? This article aims to answer these questions.

What are rare coins?

Put simply, rare coins are coins that are not easy to find or available in large quantities. The rarity may be due to several factors:

- Limited mintage : Coins produced in limited quantities.

- Historical Significance : Coins from a specific era or related to significant historical events.

- Unique Features : Coins with flaws, unique markings, or special designs.

- High Demand : Coins that are in high demand but only available in limited numbers.

- Material : Coins made of precious metals such as gold, silver or platinum, which have a high value.

popularity among collectors

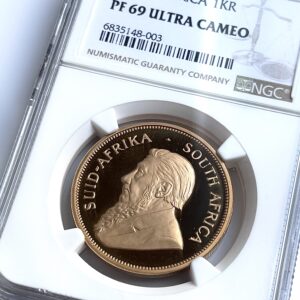

Rare coins exert a universal appeal that transcends geographic boundaries. From American Silver Eagles to the globally popular Krugerrand Proof coins, the world of rare coins is as diverse as the collectors who seek them. Auction houses often offer rare coins that fetch astronomical prices, underscoring their popularity. At international coin fairs and online forums, aficionados share their latest acquisitions or the elusive coins they are hunting.

Examples of the most expensive coins ever sold by auction houses :

In March 2022, the auction house Künker brokered a double rose Noble Piedfort from the Hanseatic city of Kampen for 700,000 euros. With an additional premium of 20%, the total amount of the transaction was 840,000 euros.

In 2021, a 1937 Edward VIII-style £5 coin broke the record for the most expensive British coin ever sold. One of the few British gold commemorative coins produced to commemorate the anticipated coronation of Edward VIII, this piece fetched $2,280,000 at a public sale of rare world coins, hosted by Heritage Auctions .

In 2021, one of the last gold coins ever minted for public use in the United States was auctioned in New York for an unprecedented $18.9 million. The extremely rare 1933 ‘Double Eagle’ is the most expensive coin ever sold at auction, almost doubling the previous world record, according to auction house Sotheby’s, which organized the sale.

The coin, which features Liberty on one side and a soaring eagle on the other, has a face value of $20. The 1933 version of the “Double Eagle” was never released to the public, and most were taken back by the US government to be melted down. Few of these coins escaped melting, and a limited number made it onto the market. However, an intelligence investigation in 1944 found that such coins discovered in private collections were considered stolen, as noted by Sotheby’s.

You may also be interested in:

How much is a Krugerrand coin worth – the most expensive Krugerrand coins

Investment Potential – Why look around and learn before investing?

The rare coin space presents both opportunities and pitfalls. Here you can find out why you should definitely inform yourself before investing:

- Authentication : Learning how to authenticate coins can help protect you from counterfeiting.

- Grading : Understanding the grading system helps assess a coin’s true value.

- Market Trends : A thorough study can help you identify which coins are likely to appreciate in value.

Financial benefits :

Long-Term Value : Rare coins often increase in value over time, especially if kept in excellent condition. Also interesting ->

Quick Guide – Coin Care and Maintenance: The ultimate guide to preserving your precious collection

Precious Metals: Care, Storage & Co.

Portfolio diversification : They are great for diversifying an investment portfolio.

Intrinsic Value : Precious metal coins have intrinsic value and provide a financial cushion even when markets are falling.

Liquidity : Despite their rarity, there is a buoyant market for rare coins, making them relatively liquid investments.

conclusion

Rare coins fascinate collectors and investors with their history, artistry and the thrill of hunting down an elusive, priceless piece. Their attractiveness as a sound investment is increasingly recognized and many are making substantial returns on their purchases. However, the key to a successful investment is knowledge and due diligence. Whether you are an enthusiast who appreciates the tactile connection to history or an investor looking to diversify your portfolio, rare coins offer a unique and often rewarding experience.

Discover the new additions to our gold coin collection in the current range!

-

Cuba – 1981 – 100 Pesos – Pinta – NGC MS68

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Santa Maria – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Nina – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 1993 – 1 oz Proof Gold Coin – NGC PF69 Ultra Cameo

3.300,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Mexico – 2010 – Libertad – Gold coin 1 oz – PCGS MS69

3.150,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2011 – Set – One of First 300 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2016 – Set – One of First 150 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2018 – Set – First Day of Issue – 6 Gold Coins Proof – NGC PF70 UCAM

5.750,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Bophuthatswana – 1987 – 10 years of independence – platinum – 1oz – with original case and certificate

2.195,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

South Africa – Krugerrand – GRC – 1990 – SAGCE PoV 100 – 1oz Proof Gold

3.250,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays)