When it comes to investing in gold coins, there are two main options: Proof co ins and bullion coins. Both types of coins have their own characteristics, and it is important to know the differences between them in order to make an informed decision about which coin is the better investment for you.

Bullion coins:

Bullion coins are produced specifically for investment purposes and are valued according to the weight and purity of the gold they contain. They are typically sold at a relatively small premium to the current spot price of gold, making them a popular choice for investors looking to acquire gold at a lower cost. Bullion coins are usually produced in large quantities, so they are readily available and easy to sell quickly. Bullion coins are usually minted in denominations of 1/10, 1/4, 1/2 and 1 ounce, and their value is based on the current market price of gold. The value of bullion coins is not influenced by factors such as rarity or condition, as they are valued solely on the basis of their gold content.

Proof coins/ Polished Plate (PP):

Proof coins, on the other hand, are minted specifically to showcase the craftsmanship and artistry of the mint. They are produced in smaller quantities and often sold at a premium to the current price of gold. Due to their rarity and beauty, proof coins are highly sought after by collectors and investors alike. In addition to their intrinsic value, which is derived from weight and purity, proof coins often have a numismatic value that can increase over time due to their limited production and unique design.

Valuation of gold coins by NGC or PCGS:

If the gold coin is graded, you can easily identify the proof version by the abbreviation”PF” used by NGC and the abbreviation”PR” used by PCGS. Bullion coins get”MS” = Mint State.

For example:

Krugerrand 2017 50th Anniversary Gold NGC First Releases PF70 UCAM

Ethiopia – 600 Birr – Walia Ibex – 1970/1978 – NGC MS66

RareCoin Shop sells a lot of Krugerrand gold coins and we are often asked the following question: What is the difference between Proof Krugerrands and Bullion Krugerrands, since they look pretty much the same.

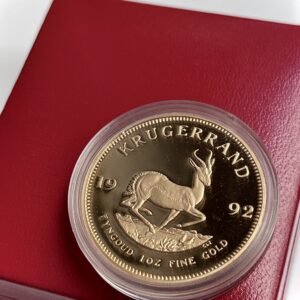

Krugerrands are gold coins minted by the South African Mint since 1967. These coins are popular with investors who want to hold gold as a store of value or as a hedge against inflation. Krugerrands are available in two forms: proof Krugerrands and bullion Krugerrands. Although both types of coins contain the same amount of gold, there are some important differences between them.

Proof Krugerrand coins:

Proof Krugerrand coins are specially minted coins intended as collector’s items. They are minted with specially polished dies that create a mirror-smooth surface of the coin. The production of a proof Krugerrand is more complex than that of a bullion Krugerrand, which means that proof Krugerrands are usually more expensive to purchase. Since 1995, Krugerrand Proof coins have been available with an original box and COA (Certificate of Authenticity). Any damage to the Krugerrand proof coin can greatly reduce the value, which is not the case with bullion Krugerrands. Some Krugerrand proofs even carry a special mint mark to commemorate special events, such as. 50th Anniversary Winston Churchill Krugerrand Gold Coin

Bullion Krugerrand coins:

Bullion Krugerrand coins, on the other hand, are designed to be bought and sold as an investment in gold. These coins are minted in large quantities and are not subject to the same care and attention as proof Krugerrands. Bullion Krugerrand coins are minted with normal dies and are not polished, which means they do not have the same visual appeal as Proof Krugerrand coins. However, they are usually cheaper than proof Krugerrand coins.

One of the main reasons investors prefer bullion Krugerrand coins over proof Krugerrand coins is that they are easier to buy and sell. Since bullion Krugerrands are intended as an investment form of gold, they are widely recognized by gold dealers and can be easily traded on the world market. Proof Krugerrands, on the other hand, are more difficult to sell quickly because they are collectibles that are usually bought and sold by collectors. In summary, the main difference between Proof Krugerrands and Bullion Kr ugerrands is that Proof Krugerrands are collectibles that are more expensive and visually appealing, while Bullion Krugerrands are intended as an investment opportunity for gold and are more recognized and easier to buy and sell.

The most popular gold coins in the world:

Whether you are a collector or an investor, there are some gold coins that are well known and popular around the world.

One of the most famous gold coins is the American Gold Eagle, which was first minted by the United States Mint in 1986. These coins are made of 22-karat gold and feature an image of Lady Liberty on the obverse and a bald eagle on the reverse. They are available in four sizes, from 1/10 ounce to 1 ounce.

Another popular gold coin is the Canadian Gold Maple Leaf, first minted by the Royal Canadian Mint in 1979. These coins are made of 24-karat gold and feature an image of Queen Elizabeth II on the obverse and a maple leaf on the reverse. They are available in five sizes, from 1/20 ounce to 1 ounce.

The South African Krugerrand is another popular gold coin that has been produced since 1967. These coins are made of 22-karat gold and feature the image of Paul Kruger, a former South African president, on the obverse and a springbok antelope on the reverse. They are available in four sizes, from 1/10 ounce to 1 ounce.

The Chinese Gold Panda is another well-known gold coin that has been minted by the People’s Republic of China since 1982. These coins are made of 24-karat gold and feature the image of a panda on the obverse. The design of the panda changes every year, which makes these coins a popular collectible. They are available in six sizes, from 1/20 ounce to 1 ounce.

Finally, the Australian Gold Kangaroo is another popular gold coin that has been produced by the Perth Mint since 1986. These coins are made of 24-karat gold and feature the image of a kangaroo on the obverse. The design of the kangaroo changes every year, making these coins a popular collectible. They are available in four sizes, from 1/10 ounce to 1 ounce.

So which coin is more suitable for investment purposes? That ultimately depends on your investment goals and personal preferences. If you are primarily looking to invest in gold to diversify your portfolio and protect against inflation, bullion coins may be a better choice as they are more readily available and sell at a lower premium over the spot price of gold. However, if you are looking for a unique and potentially valuable investment, proof coins may be a better choice due to their rarity and numismatic value.

It is important to know that both types of coins are subject to market fluctuations and the value of your investment may rise or fall depending on various factors such as the state of the world economy and supply and demand.

Discover the new additions to our gold coin collection in the current range!

-

Mexico – 2010 – Libertad – Gold coin 1 oz – PCGS MS69

3.150,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2011 – Set – One of First 300 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2016 – Set – One of First 150 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2018 – Set – First Day of Issue – 6 Gold Coins Proof – NGC PF70 UCAM

5.750,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Bophuthatswana – 1987 – 10 years of independence – platinum – 1oz – with original case and certificate

2.195,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

South Africa – Krugerrand – GRC – 1990 – SAGCE PoV 100 – 1oz Proof Gold

3.250,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

South Africa – Krugerrand – GRC – 1989 – SAGCE PoV 100 – 1oz Proof Gold

3.250,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Zimbabwe – 2022 – Mosi-oa-Tunya – 1oz Proof Gold

3.150,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

South Africa – Krugerrand – 1992 – 1oz gold coin proof with box

5.750,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Mexico – 2023 – Libertad – Gold Coin Proof 1 oz – PCGS PR70 Deep Cameo

2.950,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays)