The field of coin collecting, also known as numismatics, encompasses a broad spectrum ranging from the casual enthusiast to the serious investor. One of the biggest attractions of coin collecting is the fact that it is both a hobby and an investment. The materials of the coins and their different properties play a crucial role in determining the value, rarity and desirability of coins. Below we examine the different coin materials and qualities and their importance for investments and hobbies.

Gold coins :

Gold has always been a symbol of wealth and power. Gold coins have been minted since ancient times and remain popular among both collectors and investors. As a precious metal, gold retains its value, making gold coins a hedge against inflation and economic downturns. For collectors, the appeal often lies in the historical significance, the artistic design or the rarity of the coin.

Silver coins :

Silver coins are another popular choice in the world of numismatics. While they typically have a lower monetary value than their gold counterparts, silver coins have a rich history and are more accessible to beginners. From ancient drachmas to the American Silver Eagle, silver coins represent a tangible piece of history. Since silver is used in industry, these coins can also serve as a practical investment.

Platinum coins :

Platinum is rarer than gold and silver, which is why platinum coins are particularly sought after. Often minted as commemorative or limited edition coins, these coins can be both beautiful and valuable. Its rarity combined with the industrial demand for platinum makes it a solid investment opportunity for those looking to diversify their precious metals portfolio.

Coins in mint condition :

A coin in “mint condition” is in substantially the same condition as it was at the time it was produced. Such coins show no signs of wear, and the details of the coin’s design are sharp and clear. Freshly minted coins are particularly valuable for collectors and investors because they represent the coin in its purest form, untouched by time or external factors.

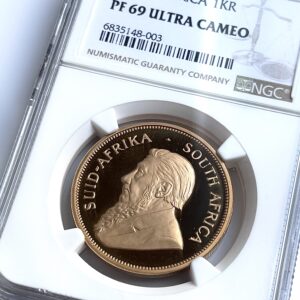

Proof coins:

Proof coins are specially minted coins characterized by their reflective background and frosted, raised elements. They are made using a unique process in which the coin is minted multiple times to achieve a high level of detail. Proof coins are generally not intended for circulation but are produced for collectors. Due to their exceptional quality and limited mintage, they are often more valuable than their regular counterparts, the bullion coins .

Graded Coins :

Grading is the process of evaluating the condition of a coin. It is advisable to have your collectible coins graded to protect the value of your collection. Graded coins are assessed for quality and grade by professional agencies such as the Numismatic Guaranty Corporation (NGC) or the Professional Coin Grading Service ( PCGS ). The grading scale typically ranges from 1 to 70, with higher numbers indicating near-perfect condition of the coin. Investing in graded coins provides investors with additional security regarding the authenticity and condition of the coin.

Uncirculated coins :

Uncirculated coins have never been used for everyday transactions, so they do not show the typical wear and tear that occurs with circulated coins. Even if they are not in absolute mint condition, their authenticity is very attractive to both collectors and investors.

Finally:

In the dynamic world of numismatics, the appeal of coin collecting lies in its diverse appeal as an exciting hobby and strategic investment. The complex dance of history, art and economics found in coins, regardless of material or quality, provides a tangible connection to the past and a potential path to financial growth. From the timeless value of gold coins to the pristine beauty of uncirculated pieces, each category offers a unique narrative and financial offering. For both amateur collectors and investors, understanding and appreciating the nuances of coin materials and qualities can enrich the collecting experience and increase return potential. Whether with the heart of a historian or the mind of an investor, coin collecting is a testament to the enduring value and allure of material assets.

Other interesting articles: The Best Gold Coins to Invest: A Comprehensive Guide Getting started in gold coin collecting: considerations, uncertainties, and benefits. The advantages of buying platinum coins Gold and its propertiesDiscover the new additions to our gold coin collection in the current range!

-

Cuba – 1981 – 100 Pesos – Pinta – NGC MS68

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Santa Maria – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Nina – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 1993 – 1 oz Proof Gold Coin – NGC PF69 Ultra Cameo

3.300,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Mexico – 2010 – Libertad – Gold coin 1 oz – PCGS MS69

3.150,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2011 – Set – One of First 300 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2016 – Set – One of First 150 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2018 – Set – First Day of Issue – 6 Gold Coins Proof – NGC PF70 UCAM

5.750,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Bophuthatswana – 1987 – 10 years of independence – platinum – 1oz – with original case and certificate

2.195,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

South Africa – Krugerrand – GRC – 1990 – SAGCE PoV 100 – 1oz Proof Gold

3.250,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays)