The debate about the role of gold as money has been a topic of discussion for centuries. Gold has a long history as a medium of exchange and store of value. It was prized for its scarcity, durability and beauty, making it a sought-after asset for individuals, corporations and governments. However, with the advent of fiat currencies (fiat currency refers to a means of payment that has been artificially created by a government or state and has no intrinsic value) and the modern financial system, the question arises: is gold still as good as money?

Gold has several properties that make it attractive as a form of money. First, it is inherently valuable. Unlike paper money, which traces its value to government decisions, gold has intrinsic value because of its rarity and unique properties. It cannot be arbitrarily created or replicated, which ensures its rarity and preserves its value over time. This has made gold a reliable store of value for thousands of years.

Secondly, gold is durable and does not corrode. Unlike paper money, which can deteriorate or be damaged, gold is unaffected by time. It can be stored for long periods of time without losing its physical integrity, making it an ideal medium of exchange for generations. Historically, gold has been used as a means of payment in various civilizations, and even today, gold reserves are held by central banks to back their currencies.

In addition, gold enjoys universal recognition and acceptance. It is widely considered a symbol of wealth and has been valued in various cultures throughout history. The global recognition of gold means that it can be exchanged for goods and services in different parts of the world, making it a form of money that crosses borders. Additionally, gold has proven to be a hedge against inflation and economic uncertainty, providing stability in times of financial turmoil.

However, there are arguments against gold being as good as modern fiat currencies. One of the main criticisms is the lack of convenience. Carrying physical gold can be cumbersome and risky, as it can be stolen or lost. In contrast, digital currencies and electronic payment systems have made transactions faster, easier, and more secure. The physical nature of gold may limit its suitability as a medium of exchange in the digital age.

Moreover, gold does not yield any income or interest. Unlike money held in bank accounts or invested in other financial instruments, gold does not yield a return. It is a non-productive asset based solely on its value as an asset store. At a time when financial assets and interest-bearing assets are in high demand, gold’s lack of yield potential can be seen as a disadvantage.

In addition, the value of gold can be subject to significant fluctuations. Even though the price of gold has always maintained its value in the past, it is influenced by market forces and can be subject to strong fluctuations. This volatility can make gold a less stable form of money compared to government-issued currencies, which are typically managed by central banks to provide stability.

Digital gold vs. physical gold – reasons to invest in physical gold

Investing in physical gold is a long-standing strategy for wealth preservation and financial security. Although there are several investment options available in today’s market, physical gold remains a popular choice among investors. Below are some compelling reasons why investing in physical gold can be a wise decision:

Tangible and intrinsic value: Gold is a tangible asset that has been valued by civilizations for thousands of years. Its rarity, longevity and aesthetic appeal make it universally recognized and valuable. Unlike paper-based investments, physical gold offers a sense of security because it can be held, stored and owned directly.

Hedging against inflation: Gold has always served as a hedge against inflation. When the value of currencies erodes due to rising prices, the purchasing power of gold usually remains relatively stable. Adding physical gold to your investment portfolio can protect your assets from the erosive effects of inflation.

Diversification: Gold offers diversification benefits in an investment portfolio. It has a low correlation with traditional financial assets such as stocks and bonds. This means that gold often moves independently of other assets and is a potential hedge in times of economic uncertainty or market volatility. By adding physical gold to your investment mix, you can reduce the overall risk of your portfolio and increase its resilience.

Safe haven: Gold is often referred to as a “safe haven”. In times of economic or geopolitical turmoil, investors tend to use gold as a store of value. The yellow metal has long been known to preserve assets in times of crisis, and has proven its resilience even during market downturns. Owning physical gold can provide a sense of security and serve as an insurance policy for uncertain times.

Global acceptance: Gold is accepted and valued worldwide. It crosses borders and can be easily exchanged for cash or goods in almost any country. This universal acceptance and liquidity make it a highly desirable asset that offers flexibility in times of need.

Store of wealth: Gold has proven itself as a store of wealth over the long term. Unlike paper currencies, which can become devalued or worthless, gold retains its intrinsic value over time. Its scarcity and limited supply help it retain its purchasing power and serve as a reliable store of wealth.

Portfolio Insurance: Adding physical gold to your investment portfolio can act like a form of insurance. It helps mitigate the risks associated with economic instability, currency devaluation and financial market fluctuations. As a non-correlated investment, gold can help offset potential losses in other areas of your portfolio, reducing overall risk.

Potential for value appreciation: While gold is primarily seen as a wealth preserver, it also has the potential to increase in value over the long term. As global demand for gold continues to increase due to factors such as industrial use, jewelry, and investment needs, the limited supply of gold may lead to higher prices. When you invest in physical gold, you can benefit from potential capital gains.

You may also be interested in:

How much is a Krugerrand coin worth – the most expensive Krugerrand coins

It is important to know that investing in physical gold comes with some considerations, such as storage and security costs. In addition, market conditions and economic factors may affect the short-term price fluctuations of gold. Therefore, it is advisable to do thorough research, seek professional advice, and carefully consider one’s financial goals and risk tolerance before making an investment decision.

You may also be interested in:

The Three-Spoke Rule: Proven Investment Strategy for More Wealth and Prosperity

Summary

In summary, the question of whether gold is as good as money depends on various factors and perspectives. Gold has properties that have made it a trusted means of payment throughout history. Its intrinsic value, longevity and worldwide recognition make it a reliable store of value. However, the rise of digital currencies, the convenience of electronic payment systems, and the lack of income generation from gold call into question its status as a practical medium of exchange in today’s modern financial landscape. Ultimately, the suitability of gold as money is a matter of personal preference, economic circumstances, and social norms. In addition, we see physical gold offering investors a number of benefits, including tangibility, inflation protection, diversification and long-term wealth preservation. By including physical gold in your investment strategy, you can increase the stability of your portfolio, protect against economic uncertainties, and secure your financial future.

Discover the new additions to our gold coin collection in the current range!

-

Mexico – 2010 – Libertad – Gold coin 1 oz – PCGS MS69

3.150,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2011 – Set – One of First 300 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2016 – Set – One of First 150 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2018 – Set – First Day of Issue – 6 Gold Coins Proof – NGC PF70 UCAM

5.750,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Bophuthatswana – 1987 – 10 years of independence – platinum – 1oz – with original case and certificate

2.195,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

South Africa – Krugerrand – GRC – 1990 – SAGCE PoV 100 – 1oz Proof Gold

3.250,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

South Africa – Krugerrand – GRC – 1989 – SAGCE PoV 100 – 1oz Proof Gold

3.250,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Zimbabwe – 2022 – Mosi-oa-Tunya – 1oz Proof Gold

3.150,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

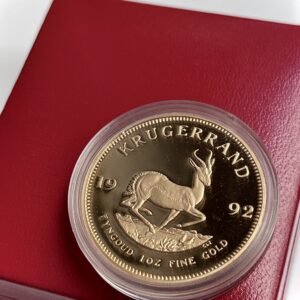

South Africa – Krugerrand – 1992 – 1oz gold coin proof with box

5.750,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Mexico – 2023 – Libertad – Gold Coin Proof 1 oz – PCGS PR70 Deep Cameo

2.950,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays)