In the fast-paced world of investing, the importance of diversification cannot be overstated. While cryptocurrencies and real estate have their merits, gold coins offer a number of benefits that make them a reliable option for investors. Below we dive into the reasons why gold coins can be a safer and potentially more lucrative choice compared to the more volatile cryptocurrency and real estate sectors.

- Tangibility and Longevity : Gold coins are tangible assets that have stood the test of time and hold their value for thousands of years. In contrast, cryptocurrencies are digital and are at risk of being hacked, becoming technologically obsolete, or even disappearing altogether. Real estate, while tangible, requires high maintenance and can lose value due to external factors such as market downturns or natural disasters.

- Liquidity : Gold coins can be easily sold or bought in virtually any part of the world. While cryptocurrencies can be traded globally, they are subject to a highly volatile market where liquidity can disappear overnight. Real estate sales can take months or even years and usually involve significant transaction costs.

- Volatility : The value of cryptocurrencies can fluctuate widely over short periods of time. While real estate is generally less volatile, it is still subject to market cycles and location-specific risks. Gold coins, on the other hand, are known for their stability, especially during times of economic uncertainty.

- Regulation and Taxation : Cryptocurrencies are still largely unregulated and investors are at risk of possible future legislation that could adversely affect their investment. Real estate is subject to property taxes, zoning laws, and other regulations that can affect profitability. Gold coins, particularly those acquired for investment purposes, are often taxed less and are less subject to changing regulations.

- Portability and Storage : Gold coins are relatively easy to store and transport, giving the investor full control over their investment. Real estate requires space and maintenance, and its value can be tied to its location, which may be subject to social, economic or environmental changes. Cryptocurrencies require digital storage solutions that may not always be secure.

- Inflation hedge : Gold has traditionally served as an effective hedge against inflation, a quality that neither cryptocurrencies nor real estate can fully claim. While some cryptocurrencies like Bitcoin are often touted as “digital gold,” they haven’t been around long enough to have a credible track record as an inflation hedge.

- Diversification : Gold coins can add a level of diversification to your portfolio that neither real estate nor cryptocurrencies can offer. While real estate offers a degree of diversification, it often correlates with the general economy. Cryptocurrencies, while diverse, are interconnected digital assets that often move in lockstep with market fluctuations.

Conclusion

Gold coins offer a mix of stability, liquidity and historical performance that neither cryptocurrencies nor real estate can match. They serve as a tangible, low-maintenance, and highly liquid asset that is not subject to the vagaries of market volatility or complex regulations. Gold coins are therefore a compelling option for those looking to build a diversified and resilient investment portfolio.

Perhaps also interesting: The Three-Spoke Rule: Proven Investment Strategy for More Wealth and Prosperity Why you should buy physical gold and silver now Precious metals – gold, platinum, palladium or silver? Which metal should I invest in?Discover the new additions to our gold coin collection in the current range!

-

Mexico – 2016 – Libertad – Gold Coin 1 oz Proof – PCGS PR68 Deep Cameo

2.950,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

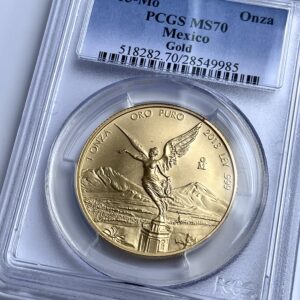

Mexico – 2020 – Libertad – Gold coin 1 oz – First Strike – PCGS MS70

3.150,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Mexico – 2013 – Libertad – Gold coin 1 oz – PCGS MS70

3.150,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Mexico – 2012 – Libertad – Gold coin 1 oz – Early Releases – NGC MS70

3.150,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2017 – 50th Anniversary – 1oz Gold – First Releases – NGC PF70 UCAM

3.600,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 1999 – 1 oz Proof Gold Coin – NGC PF70 Ultra Cameo

3.750,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Gambia – 1977 – 500 Dalasis – Sitatunga – NGC PF68 Ultra Cameo

3.200,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Sierra Leone – 1974 – One Leone – 10 years bank anniversary – original case

4.950,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Pinta – NGC MS68

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Santa Maria – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays)