How do I properly invest in gold and what about collector coins?

Investing in gold and collectible coins can be a fascinating and rewarding way to diversify your portfolio and protect your wealth. However, there are some important aspects to consider in order to invest successfully in these asset classes.

1. Basics of Gold Investment

Gold has always had a special appeal and is considered a safe haven in economically uncertain times. Investing in gold can take place in different forms:

- Gold bars and coins: Owning physical gold offers a unique sense of security. However, storage and insurance should be well thought out.

- Gold stocks and funds: These offer a more convenient way to invest in gold without having to store physical gold. However, they depend on the stock markets and the performance of individual mining companies.

- Gold ETFs and ETCs: These exchange-traded products are an easy way to invest in gold and offer greater liquidity than physical gold.

2. Collectible coins as an investment

The world of collectible coins is a fascinating market of its own that differs significantly from traditional gold investments. When it comes to collector’s coins, it’s not just the material value that counts, but also aspects such as rarity, historical significance, state of preservation and popularity among collectors.

- Build knowledge: It is crucial to gain in-depth knowledge of the history and specific market of collectible coins. The value of a coin is often determined not only by its gold content, but also by its cultural and historical relevance.

- Authenticity and Preservation: The authenticity of your coins is of utmost importance. Make sure they are genuine and look after them carefully to maintain their condition and therefore their value.

- Market observation: Since the collector coin market is subject to trends, it is important to understand and follow these developments. This will help you identify optimal times for buying and selling.

Additionally, you should build relationships with reputable dealers and experts to gain access to high-quality pieces and make informed decisions. Also consider the long-term perspective of this type of investment: collector coins can increase in value over years, especially if they are part of a sought-after series or a rare vintage.

3. Risks and Considerations

- Volatility of the gold price: The price of gold can fluctuate significantly, which poses risks but also offers opportunities.

- Liquidity: While gold is relatively easy to sell, selling collectible coins can be more difficult because it requires specific buyers.

- Diversification: Never invest all of your assets in one asset class. Gold and collectible coins should be part of a diversified investment strategy.

4. Long-term perspective

- Patience is key: Gold and collectible coins are typically long-term investments. Short-term market fluctuations should not lead to panic.

- Regular market monitoring: Stay informed about market trends and economic developments to make informed decisions.

Conclusion

Investing in gold and collectible coins can be an enriching addition to your portfolio, but requires careful consideration and research. With the right knowledge and a well-thought-out strategy, these investments can help secure and increase your assets in the long term.

Supplementary resources :

Why you should buy physical gold and silver now

The Three-Spoke Rule: Proven Investment Strategy for More Wealth and Prosperity

Different ways to invest in physical precious metals like gold

Getting started in gold coin collecting: considerations, uncertainties, and benefits.

Discover the new additions to our gold coin collection in the current range!

-

Cuba – 1981 – 100 Pesos – Pinta – NGC MS68

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Santa Maria – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Nina – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

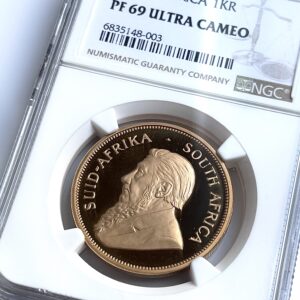

Krugerrand – 1993 – 1 oz Proof Gold Coin – NGC PF69 Ultra Cameo

3.300,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Mexico – 2010 – Libertad – Gold coin 1 oz – PCGS MS69

3.150,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2011 – Set – One of First 300 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2016 – Set – One of First 150 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2018 – Set – First Day of Issue – 6 Gold Coins Proof – NGC PF70 UCAM

5.750,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Bophuthatswana – 1987 – 10 years of independence – platinum – 1oz – with original case and certificate

2.195,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

South Africa – Krugerrand – GRC – 1990 – SAGCE PoV 100 – 1oz Proof Gold

3.250,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays)