Buying gold coins during a hype

One mistake to avoid is buying gold coins during a hype. This often causes the prices of gold coins to rise when many people are buying, which can reduce the chances of making profits and limit hedging against future inflation risks. In times of rising gold prices, you should rather sell your gold coins than buy new ones.

Excessive investment in gold coins

Another mistake is to invest excessively in gold coins. Gold coins, both bullion coins and collector coins, are not quick money makers and can even lose value in the short term. Therefore, it is not financially advisable to invest all your capital in buying gold coins in the hope of making quick profits.

Purchase of coins from unknown sources

A big mistake is buying coins from unknown sources. Inexperienced investors should avoid buying coins from unknown sources, as this may lead to counterfeiting, fraud, or inflated prices. It is advisable to buy from trustworthy dealers (Ebay shops, dealers who are listed in Germany e.g. at gold.de or gold-preisvergleich.de or MA shops, etc.) and to inform yourself well about the market and the different types of coins.

Where is it cheaper to buy?

It is rarely advisable to buy gold and platinum coins at a bargain price in banks. Specialist dealer companies are often a better choice because they specialise in precious metals and can offer better prices and advice. Reputable and competent traders are more likely to be able to provide you with comprehensive advice on this market and show you which coins are best suited for your investment strategy depending on your financial goals. In addition, unlike banks, merchants are able to organize the delivery of products to any desired address.

Do not take advice from inexperienced people

Avoid seeking advice from inexperienced colleagues, relatives, neighbors or friends, etc., when acquiring gold coins. Each individual pursues their own individual investment goals. Some seek quick profits by trying to profit from minor fluctuations in the price of gold, while others favor expensive gold coins with high premiums. Take the time to research the market on your own and stay true to your own investment plan.

Buying bullion coins without taking into account the current price of gold

It is amazing to see how many people buy gold coins without first checking how much the gold value per ounce is on the day of purchase. It is better not to purchase bullion coins without in-depth knowledge, but look for free gold price charts and follow the developments in order to identify the right opportunity in the event of a possible price decline and make the optimal purchase decision.

The purchase of rare gold coins or collector coins without appropriate numismatic knowledge is not recommended

The acquisition of rare gold coins/collector coins as an investment without adequate numismatic expertise is not advisable. In such a situation, experience is required to be able to assess the condition and minting characteristics of the coins, to understand what such coins are suitable for, as well as many other specific details. Some dishonest coin dealers try to sell collector coins as an investment. Caution! This type of coins is not intended as a financial investment, but as a collector’s item. The prices of collector coins are not only influenced by the price of gold, but also by factors such as rarity, quality, minting, popularity, grading, etc., which can significantly increase their value. If you want to invest in physical gold, especially as a beginner, it is recommended to choose well-known bullion coins with low markups. You can also purchase collector coins as an investment, but with the appropriate knowledge and a well-thought-out strategy.

The storage costs of gold coins

The expenses associated with the storage of gold should not be neglected. Someone who owns physical gold in the form of gold coins will have to spend funds on storing it in a safe of a bank or private provider. Some experts warn that this scenario could have undesirable consequences if these institutions get into trouble.

Collector coins are sold in capsules – can they be opened?

If the original packaging is not available, dealers offer the option of placing coins in capsules or special numismatic bags for bullion coins – either on their own initiative or at the request of the buyer. Usually, collector coins are sold in capsules or offered in their original packaging. Of course, the intact factory seal should not be removed or damaged. When you pick up the coin, please use gloves and look at it through a magnifying glass.

Physical gold or gold stocks – are they the same thing?

Investing in gold coins is different from other ways to invest in gold. Many people mistakenly believe that they would rather choose alternative ways of investing in gold (such as gold mining stocks, gold exchange-traded funds, and gold futures) than deal with the complexities of owning physical gold. All these forms of investment are not necessarily dependent on the spot price, as is the case with physical gold bullion coins. To invest in stocks, gold futures, and ETF funds, an investor must have advanced analytical skills and in-depth knowledge of the market, which is not the case for all beginners.

Is it advisable, for example, if you live in Germany, to purchase only German gold coins?

This decision depends on the individual goals and the existing investment plan. Bullion coins are not a German invention. Such products have been manufactured abroad for a long time, and in high quality. Nowadays, you easily have the opportunity to acquire the South African Krugerrand, the Canadian Maple Leaf, the Austrian Philharmonic, the Australian Kangaroo or other popular bullion coins.

Discover the new additions to our gold coin collection in the current range!

-

Gambia – 1977 – 500 Dalasis – Sitatunga – NGC PF68 Ultra Cameo

3.200,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Sierra Leone – 1974 – One Leone – 10 years bank anniversary – original case

4.950,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Pinta – NGC MS68

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Santa Maria – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Nina – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

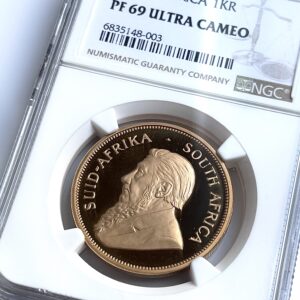

Krugerrand – 1993 – 1 oz Proof Gold Coin – NGC PF69 Ultra Cameo

3.300,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Mexico – 2010 – Libertad – Gold coin 1 oz – PCGS MS69

3.150,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2011 – Set – One of First 300 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2016 – Set – One of First 150 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2018 – Set – First Day of Issue – 6 Gold Coins Proof – NGC PF70 UCAM

5.750,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays)