In this blog, you will read about some of the differences between regular bullion coins and higher priced collectible coins.

Embossing

Minting: Bullion coins are of normal quality. They are embossed in a simple way and can be easily damaged. Collector coins can be of proof quality.

The proof is a special minting technique with a quality that exceeds that of mass coins. Proof is the highest quality minted coin. The main difference between a proof coin and any other coin is the matte image and the mirrored field. Sometimes it is the other way around: a mirror image and a dull field. This is called a reverse proof.

The price of proof coins is largely determined by the year of issue and the mintage: the older the coin and lower the mintage, the higher the price.

Design and edition

Design: bullion coins have a simple design: face value, year of issue, proof and metal content, thematic symbols. The front and back show a coat of arms, historical figure, animal, mythical figure or other symbols of the country. In the USA, for example, a golden eagle, a bison, in South Africa Paul Kruger and in China a panda. Coins are bought by investors in the hope of selling them at a profit in the future. Especially when the price of the metal begins to rise.

Circulation: For normal bullion coins, these run into the hundreds of thousands or even millions. Therefore, they are not really appreciated by collectors, unless it is a limited edition: a few hundred, rarely more than 25,000. Such special editions are very interesting for collectors, and over time their price increases. The real price of a bullion coin is equal to the exchange rate of the metal. As a rule, a premium investment coin should be sold only at its actual value (significantly higher than gold value) to a collector or dealer who specializes in it.

Important! – Collector coins are minted in small batches. Its price is influenced by supply and demand, not by the metal’s stock market quotations. The price of a gold premium investment coin can rise even if the price of gold on the stock market falls.

How to determine the value of investment gold coins

The price is the world market price for gold. In addition, there is a premium of the mint and the dealer (+5-6%).

To calculate the value of a coin, you need to know its weight and mintage. The greater the weight and the smaller the print run, the more expensive it is.

The prices for premium investment coins / collector coins / special editions / commemorative coins can best be viewed at www.gold.de or www.goldpreis-vegleich.de (of course, also for the normal bullion coins), provided that the coin is available in the trade. Alternatively, platforms such as ebay offer themselves, whereby one should then look at the finished auctions or the prices of sold coins. Otherwise, if you are not an expert, it is difficult to determine the value yourself.

Gold investment and how to make money with bullion coins

Gold investments are a good way to protect against inflation.

Buying this asset as an investment is very similar to buying precious metals. However, coins are easier to store and transport than gold bars, for example.

To make money, you must be able to sell the coins at a higher price than you bought them for. The main strategy is to buy for long-term storage, for example, at least 5 years.

How are minted proof coins

The die with which the coins are minted is made by hand. To produce a coin of the highest quality, the smallest details, such as more relief, are worked out in the die. The stamp is then polished. This is also done manually with various pastes and tools. Polishing a single die can take several hours. Polished punch can mint 300-400 coins without losing its quality. Then it is polished again.

After polishing, it’s time to mint the coin.

Bullion coins are minted only once with a die. Up to 200 coins can be produced per hour.

“Brilliant uncirculated” coins are minted twice. Up to 100 coins can be minted per hour.

Hand embossed

A Proof coin is made by hand. The die and the blank are first cleaned of particles and dust with a stream of air. The press strikes the blank up to six times. The result is of the highest quality – a sharp relief with very fine details.

After a proof coin is minted, it is inspected by hand to remove any defects. A Mint employee inspects each coin. Up to 50 proofs per hour can be embossed.

It is not only the quality of the surface that makes proof coins so attractive to collectors. Often these collector coins are minted in small editions. So, it’s not just the quality of the surface that makes proof coins so attractive to collectors. An example: The Krugerrand 1997 Sabi-Sabi 1oz gold coin was minted only 72 times and is extremely sought after on the collector market and accordingly rare and expensive.

How do I store my proof coins?

In order not to destroy the proof coins, they are stored in capsules. The original factory packaging is the best way to keep the proof coins in very good condition. The mint selects a capsule according to all parameters: exact diameter and thickness, so that the coin does not wobble or scratch, curvature and other peculiarities.

If the original capsule is cracked or broken, the coin must be transferred to a new capsule that best fits the size of the coin.

The mirrored part of a coin is very easy to damage: It can be fingerprinted, scratched or streaked.

Therefore, there are also very high quality requirements for the proof coins: The coin must be perfect. Because the condition affects the selling price. It is different with bullion coins. Their condition plays only a minor role in the price.

Why collector coins increase in value

Collector coins or premium investment coins are a unique commodity. They are produced in strictly limited edition. The greater the demand for a particular coin, the higher its value increases. Indeed, the value is regulated by the market.

Attention: unlike bullion coins, collector coins are rather rarely purchased by the bank. Unless you are willing to sell your treasure at the gold price. But this scenario is unlikely to appeal to any investor. Numismatists or dealers who specialize in collectible coins will buy the coins at a higher price.

Where and how to buy bullion coins and collector coins

The easiest and most reliable way to buy bullion coins is at banks or precious metal dealers. To complete the transaction, the potential buyer must select a coin, present his ID and pay the appropriate price. Up to 2000 euros you can currently (as of 2022) buy bullion coins or collector coins made of precious metals even anonymously.

An alternative to banks can be the purchase of coins, especially collector coins, from a precious metal dealer, online auctions, private individual, a private collector, etc.. In some cases, this can be done quite inexpensively. Nevertheless, take into account in advance all the risks that are associated with the purchase of private individuals. You can quickly become a victim of scammers.

What are the most famous gold coins?

Among the most famous bullion coins are:

the Krugerrand,

the Canadian Maple Leaf,

the American Eagle,

the Australian Kangaroo,

the Vienna Philharmonic Orchestra and

the China Panda.

But also among collector coins, the Krugerrand is one of the better known.

The South African Krugerrand is the best-selling coin in the world. It comes in denominations of one ounce/1 oz. up to 1/10 ounce. Thanks to different sizes, Krugerrand is also perfect for small investors. The higher copper content makes the Krugerrand coin very resistant to scratches.

If you are interested in buying a collectible coin, RareCoin is the place for you. We have a large selection of collector coins in stock, now and then also bullion coins. Just take your time to look around our online store and if you have any questions, we will be happy to hear from you.

Discover the new additions to our gold coin collection in the current range!

-

Cuba – 1981 – 100 Pesos – Pinta – NGC MS68

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Santa Maria – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Cuba – 1981 – 100 Pesos – Nina – NGC MS69

1.400,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

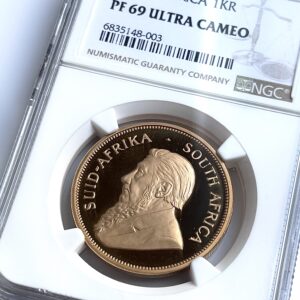

Krugerrand – 1993 – 1 oz Proof Gold Coin – NGC PF69 Ultra Cameo

3.300,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Mexico – 2010 – Libertad – Gold coin 1 oz – PCGS MS69

3.150,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2011 – Set – One of First 300 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2016 – Set – One of First 150 – 4 Gold Coins Proof – NGC PF70 UCAM

5.500,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays) -

Krugerrand – 2018 – Set – First Day of Issue – 6 Gold Coins Proof – NGC PF70 UCAM

5.750,00 €plus shippingDelivery Time: approx. 2-3 days (excluding Saturdays, Sundays and public holidays)